- Ethereum declined from the highs close to $300 only to find support marginally above $260.

- Technical indicators are sending bearish signals but the buyers must keep the price above 23.6% Fib to avoid declines back to $260.

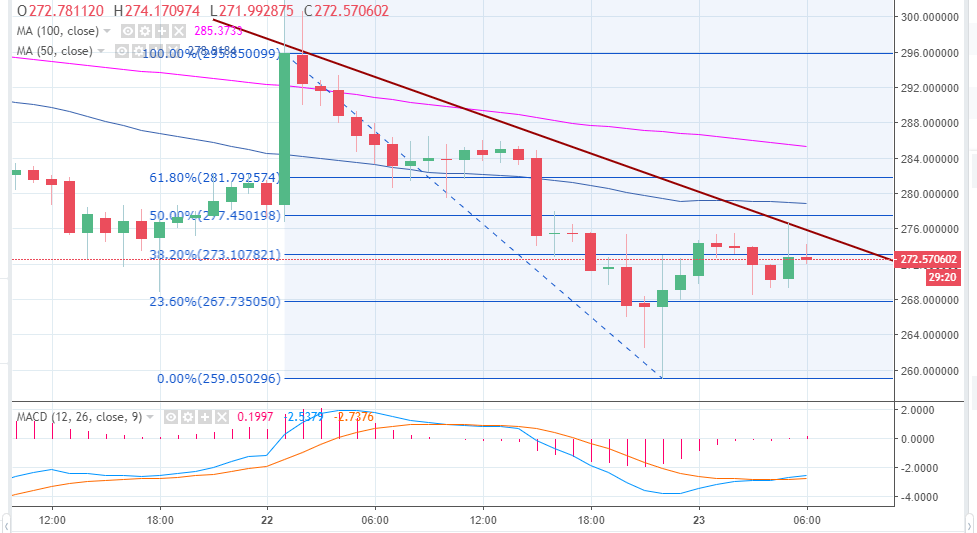

Ethereum price embarked on fresh declines yesterday break the major support at $270 (see analysis here). The bullish movement in Bitcoin (BTC) price to $6,800 had pulled most of the cryptos up with it including ETH/USD which came close to trading at $300. However, the plunge in the price of Bitcoin to $6,250 on the same time appears to have affected the second largest crypto by market capitalization. Ethereum tested the nest support target at $260 before revamping the trend to the upside.

At present, the digital asset has cleared the resistance at the 23.6% Fib level with the last swing high of $295.85 and a low of $259.05 close to $268. The price has even stepped above the resistance at $272 but corrected lower on failure to overcome $276 resistance.

The 38.2% Fib level is preventing movement to the upside at $273.09, while the trendline (bearish) will limit gains below the initial moving average resistance at $278.97 (50 SMA). The second moving average (100 SMA) resistance is at $285.31. The path of least resistance is to the south, besides the bearish trend is confirmed by the MACD ranging in the bearish zone.

Ethereum is at risk of further breakdown, therefore, the buyers need to keep the price above the 23.6% support (former resistance). On the upside, trading above the trendline resistance could open the door for more gains towards $280.