- ETH/USD bears await fresh impetus for the next leg down.

- Path of least resistance is to the downside in the near-term.

- The coin eyes $223.31 on a breach of key 200-HMA support.

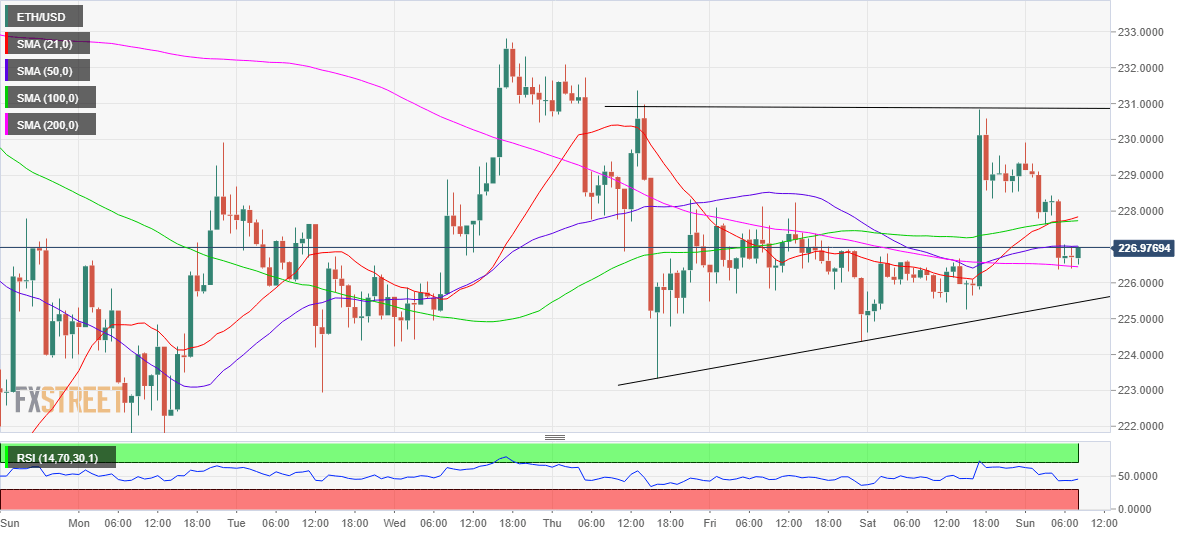

Despite the latest drop, Ethereum (ETH/USD) remains confined within its $10 week-long trading range. The second-most widely traded crypto asset reverses more than half the late Saturday rally to $230.84, as sellers return amid thin volumes and minimal volatility so far this Sunday. The price seems exposed to an additional downside, as it now loses over 1% to trade around the $226.75 region. The spot enjoys a market capitalization of about $ 25.31 billion while it looks to settle the week 2% higher.

Short-term technical outlook

ETH/USD: Hourly chart

As observed in the hourly sticks, the no. 2 coin is challenging the key 200-hourly Simple Moving Average (HMA) support at $226.44. A break below the latter is inevitable given the hourly Relative Strength Index (RSI) holding below the 50 level, the bearish territory.

The immediate cushion for the ETH bulls awaits at the rising trendline support of $225.45. Selling pressure is likely to intensify below that level, opening floors for a test of Thursday’s low of $223.31, which could keep the buyers’ hopeful.

Meanwhile, the price faces immediate resistance at the horizontal 50-HMA of $227.02. Acceptance above the last could see the next barrier at $227.80 on the buyers’ radar. The 21 and 100-HMA coincide at the level.

Further north, the critical horizontal trendline resistance at $230.86 will be eyed. Note that Saturday’s high was at $230.84.

ETH/USD: Additional levels of note