- Ethereum price loses 11% amid Evergrande crisis fears

- ETH stiff resistance upwards persists as shown by the IOMAP model.

- Ethereum’s bearish leg to continue as bears aim for $2,500.

Ethereum is trading in at $3,044.10 with a bullish bias as bulls strive to undo yesterday’s losses. The Ethereum price plunged on September 20 in tandem with a broad sell-off in the financial markets including the cryptocurrency market. The recent sell-off was led by fears that the Chinese real estate bubble was about to burst.

The ETH/USD price dropped 11% from the $3,332 opening price on Monday to close the day around $2,970. At some point, Ethereum price as much as 12.36% to lows of about $2,921 on Binance. Other cryptocurrencies in the crypto market followed the market leader, Bitcoin (BTC) which fell as much as 9.87% to lows around $42,664 while ‘Ethereum killers’ Cardano (ADA) and Solana (SOL), which have been rallying over the last couple of weeks lost 8.95% and 13.15% respectively. The exchange tokens, the Binance Coin (BNB) and the FTX Token (FTT) plunged by 11.46% and 13.06% respectively. Other top coins fell in tandem.

Evergrande Liquidity Crisis Looms

The value of the cryptocurrencies in the world fell to below $1.9 trillion on Monday. This represented an 11% loss from 24 hours before. This lasted crypto market crash shed more than $250 billion from the overall crypto market cap according to data from CoinMarketCap.

The drop imitated the mood in the broader market as United States equities plunged bearish sessions in both the Asia-Pacific and European indexes. World’s major currencies such as the GBP, EURO, CAD and the CHF all plunged against the dollar. On the upside, the U.S. dollar and government bonds surged amid haven-buying.

At the centre of September 20 sell-off was a potential housing bubble crisis brewing in China. The Chinese property developer Evergrande faces a debt burden of more than $300 billion and has issued warnings that it might forfeit a critical interest payment deadline on its offshore bonds, due on September 23.

Following these news, the shares of Chinese real estate giant Evergrande, plunged to their lowest level in 11 years, triggering a panic sell-off as analysts warned that the collapse of the company could have ripple effects across the world economies.

According to a DW news bulleting, if Evergrande collapses, it could bring down many banks with it, likening it to the 2008 USD housing bubble crisis initiated by the collapse of Lehman Brothers.

The panic selling in the crypto market was also fuelled by increasing regulatory scrutiny. For example, Bloomberg reported over the weekend the Binance, the largest crypto exchange in the world was being investigated by US regulators for market manipulation and possible insider trading.

As the cryptocurrency prices crashed, Nayib Bukele, the El Salvador President announced in a tweet that the country had “bought the dip”, taking advantage of the falling prices to increase the nation’s Bitcoin holdings 700.

Ethereum Price Could Fall To $2500

Ethereum traded below the $2,900 area identified last week as the main target for ETH bears. After dropping as much as 12.36% on Monday, ETH reached a low of around $2,921. This is lower than the low of $2,962 reached after the September 07 flash crash.

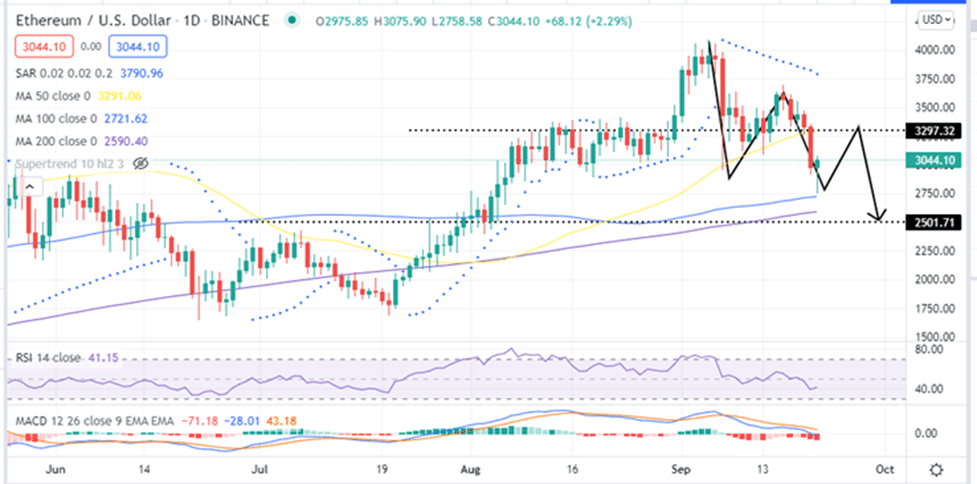

ETH/USD Daily Chart

Therefore, if bears push the Ethereum price below Yesterday’s close around $2,970, it will indicate a bearish breakout. This will be confirmed if Ethereum is pulled below today’s intra-day low around $2,761 which could see the largest altcoin tag the 100-day Simple Moving Average (SMA) around $2,727 and the 200-day SMA at $2,593.

Flipping the 200-day SMA from support to resistance could see the Ethereum price drop further to towards the $2,500 support floor.

The technical indicators show that Ethereum price prediction is bearish. For example, the position of the Relative Strength Index (RSI) around 43 indicates that the bearish pressure is stronger than the bullish pressure.

Also note that the Moving Average Convergence Divergence (MACD) indicator is moving downwards below the signal line adding credence to ETH’s bearish narrative. Note that Ethereum’s bearish bias will be further validated if the MACD crosses below the zero line into the negative region.

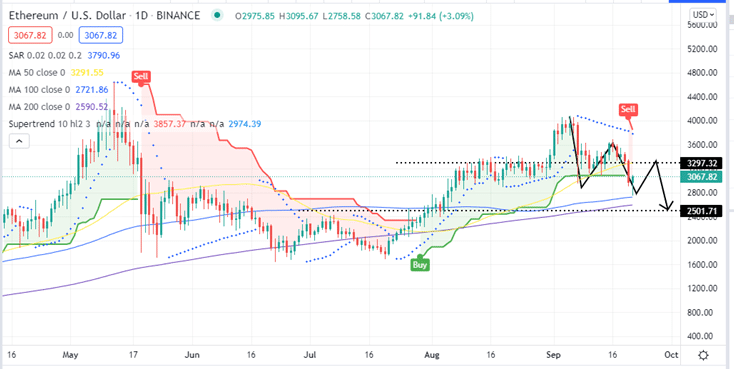

Moreover, the SuperTrend indicator send a sell signal yesterday and flipped above the price on the daily chart. This tool follows the trend of an asset like the moving averages, but as it overlays the chart, it calculates the volatility, thereby sending buy and sell signals. The SuperTrend sent a bearish signal when it moved above the price and turned red. As long as the sell signal on Ethereum’s chart holds, the downtrend is set to continue.

Ethereum Price Chart

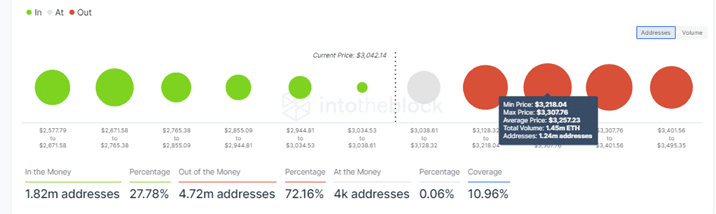

Ethereum’s bearish outlook could be invalidated if the bulls sustain the current bullish momentum and push the asset to close the day above the immediate resistance at $3,297. However, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model indicates that Ethereum faces massive resistance upwards. The IOMAP chart shows that ETH’s support downwards is relatively weak.

Ethereum IOMAP Chart

On the other hand, the resistance upwards is stiff as seen on the same IOMAP chart. For example, the resistance around the $3,250 resistance area is within the $3,218 and $3,307 price range where approximately 1.45 million ETH were previously bought by $1.24 million addresses. These investors might want to break even curtailing any further efforts to push the Ethereum price beyond this point.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk