- Ethereum price rises 6% in seven days to trade above $3,250.

- ETH must overcome the $3,380 resistance to sustain the uptrend.

- IntoTheBlock’s IOMAP model reveals that Ether faces little resistance upwards.

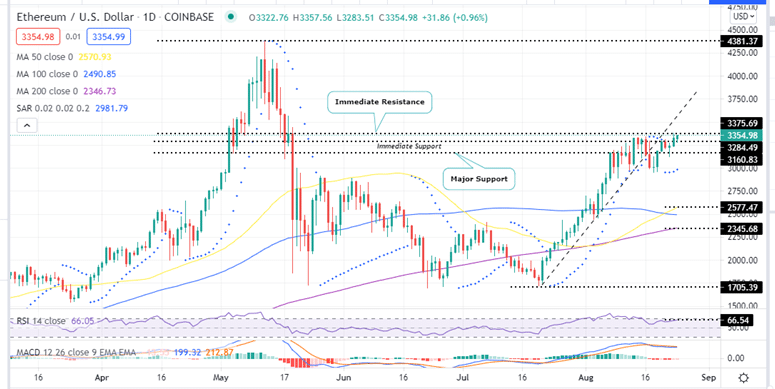

The Ethereum price prediction remains bullish after rising by 0.5% over the last 24 hours (6% in 7 days). ETH is currently trading in the green for the second day this week after correcting from the losses witnessed over the weekend. According to technical indicators, the smart contracts giant token shows a sustained bullish momentum as bulls eye a 30% to the May all-time high at $4,362.35.

Note that since July 21, Ethereum has been on a steady rise as shown by the July rising trendline on the daily chart.

Ethereum buying appetite reemerges as fundamentals kick in

Several key developments in the cryptocurrency space over the past few days give investors a reason to go long for ETH. Last week, Coinbase indicated that it would buy $500 million worth of crypto on its balance sheet and assign 10% of its profits in growing its crypto asset portfolio.

In a blog posted on their website on August 20, Alesia Haas, finance chief at Coinbase said the firm plans to invest in “Ethereum, Proof of Stake assets, DeFi tokens, and many other crypto assets supported for trading on our platform.” This makes Coinbase the first public company to do invest in cryptocurrency.

In other news, PayPal announced that it would launch its service to let its UK customers buy, hold and sell digital currencies. In an announcement made on Monday August 23, the online payments giant indicated that that it is opening up crypto services to its customers in the UK allowing them to buy, sell and hold Ethereum (ETH) and other major cryptocurrencies such as Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH) through PayPal’s website and mobile app. This step increases the adoption of digital assets because PayPal has over two million active users in the U.K.

Meanwhile, Ethereum, the blockchain network powered by ether, activated a key upgrade earlier this month. The London hard fork upgrade included the implementation of EIP-1559 which burns gas fees instead of handing them to miners. Since the launch of EIP-1559, the total number of coins burned has now topped 82,916 ETH which are worth $277,089,467.

Such developments help to maintain the positive sentiments which are lifting the ETH price.

Ethereum Price Recovery Not Over

Seller congestion at the $3,335 resistance level tried to stall Ether (ETH) on August 21, but the bulls did not allow the price to fall below the $3,200 psychological level. This suggests that Ethereum’s market sentiment remains bullish and investors are buying on minor dips.

ETH/USD Daily Chart

Currently ETH/USD is changing hands around $3,354 as bulls try to sustain the price above the overhead resistance at $3,380. If the manage to overcome the $3,380 resistance, the Ethereum price could resume its uptrend and rally to $3,670. An extended bullish leg could see ETH retest the May ATH high around at $4,362.35, representing a 30% rise from the current price.

To achieve this, ETH beak out above the July rising trendline to ensure that the uptrend is sustained.

Technical Indicators Validate Ethereum Price Bullish Bias

Several bullish crypto signals accentuate this bullish outlook. For example, the Moving Average Convergence Divergence (MACD) indicator favours ETH’s bullish momentum. Its position above the neutral line in the positive zone shows that buyers are in control of Ethereum. Also note that the MACD sent a call to buy signal on Monday on the 12-hour chart. This occurred when the MACD line (blue) crossed above the signal line (orange) validating ETH’s bullish bias.

Moreover, the current position of the Relative Strength Index (RSI) at 60.54 indicates that the bulls are in the driving seat. Furthermore, the Parabolic SAR reversed from negative to positive on August 21 adding credence to the bullish thesis.

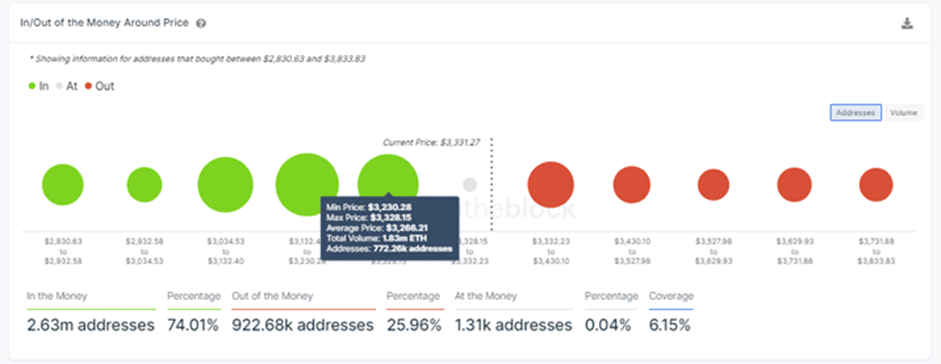

This bullish bias is also supported by metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model which indicates that Ethereum is facing little resistance upwards. Its immediate resistance at $3,380 is within the $3,332 and $3,430 price range where approximately 355,000 addresses previously bought 377,000 ETH.

Ethereum IOMAP Chart

In comparison, Ethereum sits on robust support. The immediate support at $3,284 is within the $3,230 and $3,328 investor cluster where approximately 772,000 addresses purchased around 1.83 million ETH. As long as this support remains intact, bulls will keep their focus on lifting to the $4,000 psychological level.

On the flip side, if Ethereum breaks down below this level, it would trigger immense sell orders amid intensifying losses toward $3000. Further losses would be prevented by the 50-day Simple Moving Average (SMA) at $2,577, 100 SMA at $2,500, and the 200 SMA at $2,345 respectively..

Where to Buy Ethereum

The top exchanges for trading in ETH currently are: eToro, FTX, Kraken, Gemini, Binance and Coinbase. You can find others listed on our crypto exchanges page.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk