- Ethereum price sn trading in a tight range above the 20-day SMA.

- Holding above the $3200 support embraced by the 20 SMA is crucial for a bullish breakout.

- Increased institutional adoption of cryptos to increase buying appetite for ETH.

Ethereum price is consolidating in a sideways price action. ETH/USD price is being pressured from both sides as buyers and sellers fight to overpower each other. This has seen Ethereum trade in a tight range with a break-out in the offing.

Ethereum seems to have found formidable support provided by the 200-day Simple Moving Average (SMA) which is critical to see the smart contracts token rally again to break above the upper boundary of the Bollinger Band at $3,390.

Ethereum Trading In A Tight Range Between $3,015 and $3,390

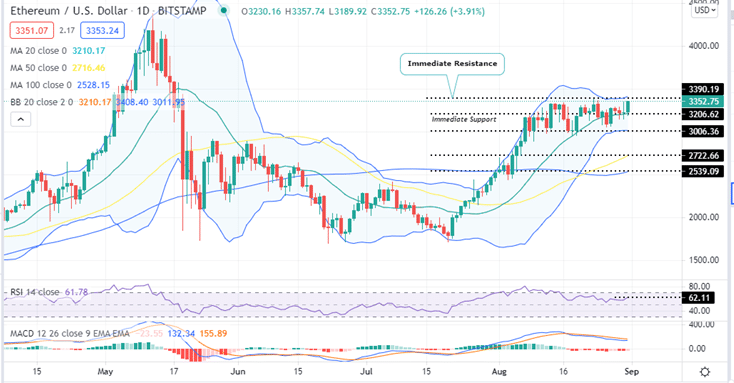

The Ethereum price volatility has been decreasing since August 08. The reducing price volatility continues as the outer boundaries of the Bollinger Band (BB) continue squeezing towards the midline. This has seen the ETH price hovering between the $3,390 and the $3,015 support wall.

At the time of writing, ETH teeters around $3,351 as bulls continue to flex their muscles to push the price higher above the $3,390 resistance area. Note that a daily candlestick above below this level will firm the bullish grip as gains towards the $3,400 psychological level.

ETH/USD Daily Chart

The 20-day SMA Support Crucial For A bullish Breakout

The Ethereum price prediction is bullish as long as bulls hold on to the support provided by the 20-day SMA. Note that the August 04 rally led to oversold conditions that saw ETH start consolidating in a sideways price action. The traders have held Ethereum between $3,015 and $3,390 levels which have held as the price has not significantly broken below or above these points.

The reason for a bullish breakout from the tight range is because Ethereum is currently sitting on strong support provided by the 20-day Sama around $3,200. Ethereum price gas closed the day above this level for the past three sessions and is strongly bullish as it trades above it at the moment. I can, therefore, see ETH holding this support in the near future with the next logical step being a bullish breakout over the next few sessions.

This bullish bias is accentuated by the upsloping SMAs and the bullish parabolic SAR as seen on the daily chart. In addition, the upward movement of the Relative Strength Index (RSI) indicator currently at 62.11 indicates that the bulls are in control of the Ethereum price.

Even though the Moving Average Convergence Divergence (MACD) indicator has been bearish over the few sessions, its position above the zero line in the positive region is an indication that ETH market momentum is largely positive.

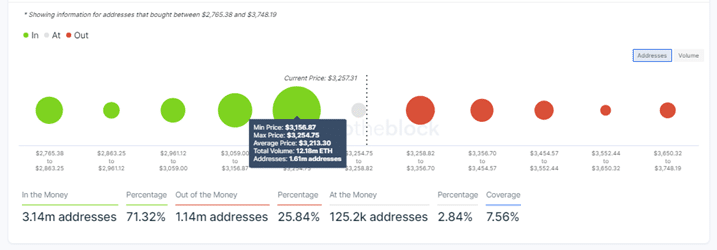

Moreover, on-chain metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model adds credence to this bullish bias. According to the IOMAP, ETH currently sits on very strong support at around the $3200 mark, right where the 20-day SMA is hovering coinciding with the BB midline . this point is within the $3,156 and $3,254 price range were over 1.25 Million addresses have bought over 12.1 Million ETH. This support is robust enough to absorb any selling pressure that might ensue pointing to an impending increase in the Ethereum price.

Ethereum IOMAP Chart

The same IOMAP chart shows that Ethereum’s journey upwards is relatively easy as the resistance is not as robust. For example, the immediate resistance at $3,390 is within the $3,356 and the $3,454 price range where only around 356,000 ETH were previously bought by around 266,000 addresses.

Increased Institutional Adoption To Bolster The Ethereum Price

Apart from the technical indicators, it is expected that improved institutional adoption of cryptocurrencies will increase buyer’s appetite for cryptos including Ethereum.

Last week, PayPal announced that it was allowing its UK customers to buy, sell and store Ethereum (ETH) and other major cryptocurrencies such as Bitcoin (BTC), Litecoin (LTC) and Bitcoin Cash (BCH). The same week Citi Group was seeking regulatory approval to trade Chicago Mercantile Exchange (CME) Bitcoin futures.

A part from the Bill legalising Bitcoin as legal tender being passed into law in El Salvador, Cuba now recognizes and is regulating cryptocurrencies such as Bitcoin.

In a Resolution 215 published on August 26 by the state-run Official Gazette, Cuba’s central bank revealed its plans to roll out new rules regulating crypto assets. According to CNBC, the development implies that commercial providers of related services are now required to secure a license to operate from the central bank.

Apart from governments, commercial entities are also increasingly accepting crypto’s such as Ethereum as payment. For example, Swiss Luxury Hotel Chedi Andermatt is set to accept Bitcoin and Ethereum payments. In an announcement made on the company’s website, the hotel said it was partnering with payment-service provider Worldline as well as Swiss crypto service provider Bitcoin Suisse for the project. The hotel also said that once they are confirmed, the received crypto payments will be immediately converted into Swiss francs.

Switzerland has been among the most enthusiastic European countries in embracing cryptocurrencies and increased acceptance from other countries around the world will increase buying appetite for Ethereum not only now but in the long run.

Looking Over The Fence

On the downside, a daily closure below 20-day (SMA) coinciding with the BB mid-line at around $3,200, ETH bears will attempt to push the Ethereum price lower towards the 50-day SMA at $2,722 and the 100-day SMA at $2,540.

How to Buy ETH Now

If you want to buy Ethereum, you can do so on the following crypto trading platforms:

- eToro

eToro is one an FCA regulated platform with over 20 million user globally. eToro charges low trading fees and commissions.

- FTX

FTX is one of the largest exchange platforms that supports a wide range of cryptocurrencies and trading pairs. It also offers user-friendly features.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk