- The upgrades will take effect at block 7,280,000 of the Ethereum blockchain.

- The bears’ influence is still apparent in spite of the 3.71% rise on the day.

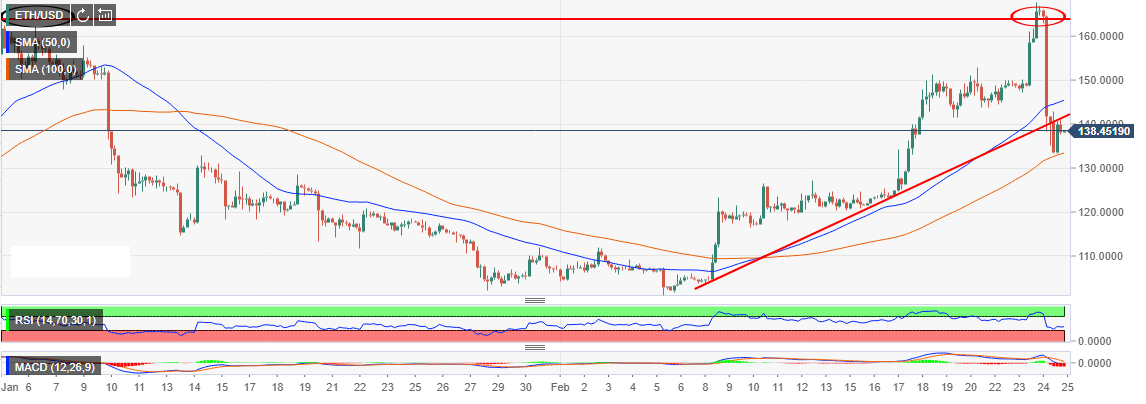

The reaction to a weekend double-top pattern took center stage as soon as Ethereum broke above the medium-term hurdle we discussed last week at $160. The crypto had sustained the uptrend trading higher highs and higher lows since the first week of February. Ethereum scaled the levels at $130, $140 and brushed shoulders with $150. However, throughout the trading last week, Ethereum failed to sustain growth above the hurdle.

Ethereum developers are still getting ready for the network upgrades; the Constantinople and St. Petersburg. Both of these upgrades are planned to take place this week according to a blog post published by Ethereum on February 22. Particularly, the upgrades will take effect at block 7,280,000 of the Ethereum blockchain which is likely to fall on February 28. However, their implementation will be carried out a couple of days after the mentioned date. According to Cointelegraph:

“Constantinople will bring the platform multiple efficiency improvements, as well as the delay of the so-called “difficulty bomb” and the decrease of Ethereum’s block reward.”

Meanwhile, Ethereum achieved highs of 167.76 on Sunday before the bears swept in sending the crypto tumbling down below $140 support. At present, the digital asset is trading at $138.24. It is also supported by the 4-hour 100-day Simple Moving Average (SMA) while the upside is capped at $140. Slightly above this level, the bulls will face more resistance at the 50-day SMA.

The Relative Strength Index (RSI) in the same range had touched the oversold but has recovered to 40.00 while the Moving Average Convergence Divergence (MACD) is still crossing into the negative region to show that the bears’ influence is still apparent. Ethereum must recover above $140 in order to stop the declines’ streak it has fallen into since yesterday.

ETH/USD 4-hour chart