- Ethereum is back at critical $200.00 vulnerable to further short-term losses.

- Sharding technology will allow improving ETH scalability.

Ethereum (ETH) hit the bottom at $196.70 and attempted a recovery to $208.68 only to retreat to $200.50 by the time of writing. ETH/USD is still down over 12% on a day-to-day basis, moving in sync with the market.

ETH/USD: Technical picture

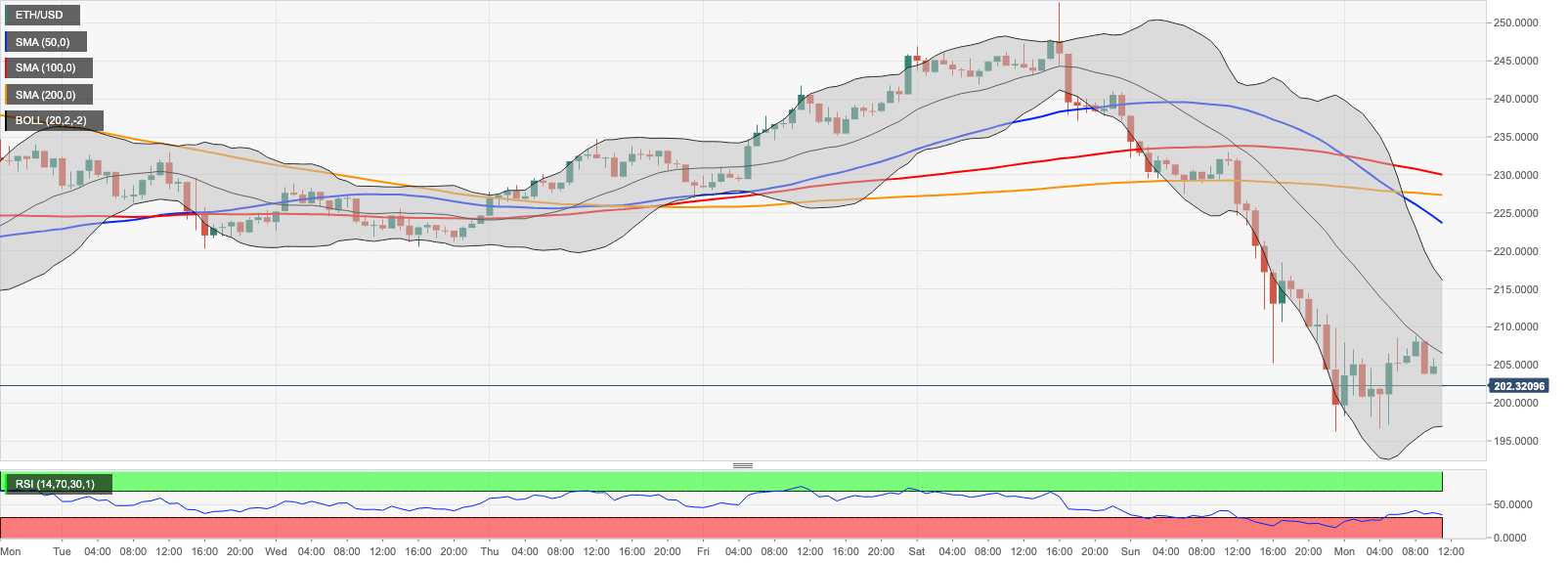

From the short-term point of view, ETH/USD hit the brick wall created by the middle line of 1-hour Bollinger Band on approach to $209.00. The retreat pushed the price back towards the psychological $200.00. If it is sustainably broken, the sell-of may gain pace and push the coin towards the recent low around $196.00. The next support is created by the lower line of the daily Bollinger Band at $194.50. The major barrier comes at psychological $190.00 followed by a confluence of SMA100 and SMA200 daily at $180.00.

On the upside, a sustainable move above $210.00 will open up the way towards $219.00, reinforced by SMA50 daily. Once it is out of the way, the upside is likely to gain traction with the next focus on $223.00 (SMA50 1-hour) and $230.00 (SMA100 1-hour).

ETH/USD 1-hour chart

Sharding to increase Ethereum’s productivity

At the ETHLondonUK conference, Vitalik Buterin and Consensys co-founder Joe Lubin raised the topic of sharding and the use of public networks in the DeFis.

Sharding is a first-level scalability solution that uses micro-networks to verify separate transactions on the Ethereum’s blockchain. This technology allows sharing work between smaller groups of nodes and thereby scaling ETH to 100 transactions per second.

He said that the solution is under development and can be implemented this year with the transition to Ethereum 2.0, noting the inevitability of the product entering the market.

Buterin pointed out to Tornado Cash project, which implemented confidential transactions; he added that Ethereum users will see improved privacy as soon as the next year.

Meanwhile, Joe Lubin shared his views on growing Ethereum’s ecosystem in the corporate sector and the increasing interest in DeFi. He believes that large and medium-sized companies will begin to transfer an important part of their business operations to public blockchains, registering more and more products, creating more open finances.

However, the development will depend on the progress made by Ethereum in terms of privacy improvement.