- Ethereum slumps to $270 support after rallying past $280 riding on fresh volatility.

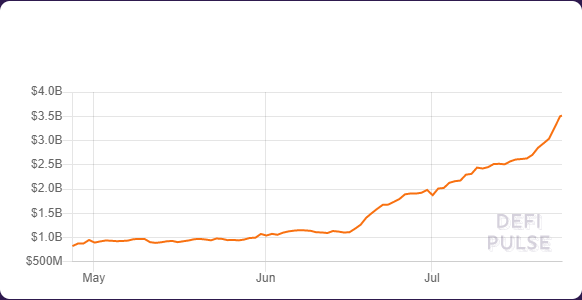

- DeFi funds hit $3.5 billion with projects supported by Ethereum in the lead.

- Ethereum high transaction fees pose a security risk to the network according to the co-founder Vitalik Buterin.

Ethereum has in the last couple of days proved that it is no longer a sleeping giant. From last week’s support at $228, ETH/USD hit new July highs above $280. As the upward trend is renewed, investors are looking towards $300 in the near term as discussed in the price prediction on Friday.

The DeFi overview

DeFi, otherwise, known as decentralized finance is an emerging ecosystem that in its own measure a current ‘Ethereum killer app.’ The era of initial coin offerings (ICOs) is long gone and the digital economy is looking at the next wave of digital finance. DeFi refers to a collection of semi-familiar financial products that have been rekindled on a blockchain platform.

For instance, a user can deposit some funds on a platform as collateral, take a loan to spend elsewhere without the platform ever knowing who the user really is. This is the new wave of digital finance: Completely different from traditional banking.

According to DeFi Pulse, a platform that monitors the progress of the ecosystem, about $3.5 billion is currently locked in various projects including Compound and Aave. Maker leads in the number of funds locked in DeFi at $740 million. Aave comes second at $605 million ahead of Compound which has $552 million. Synthetix and Curve Finance complete the top five largest DeFi projects with $499 million and $387 million respectively.

Ethereum 2.0 final testnet launch date announced

Ethereum network developers have this week announced a new and final testnet for Ethereum 2.0 protocol. The announcement comes after a successful run on Altona testnet that has support for client teams. The upcoming testnet, Medalla, on August 4 will be a multi-client platform.

Medalla is a huge step as the testnet is built for and maintained by the community. All the other testnets before this were regarded as “devnets” as they were mainly executed by client teams as well as members of the Ethereum Foundation.

Ethereum high fees threaten network security

According to Vitalik Buterin, the co-founder of Ethereum, the soaring transaction fees within the network could undermine the security of the network. Buterin was working with a hypothesis that miners could interfere with how transactions operate in order to massively increase their profits. At the time of Buterin’s comment, Ether transaction fees were drawing closer to 100 gwei.

There is a need to respond and remedy the situation as referenced by Ryan Adams, the founder of Mythos Capital who said that developers must “find ways to fit more value in each block.” Buterin is pushing for the implementation of the Ethereum Improvement Proposal (EIP) 1599 which seeks to burn the base fees in order to remove miners’ dependency on transaction tariffs. However, many within the network are yet to warm up to the idea.

Ethereum technical analysis

Ethereum price has retreated to $270 support after failing to sustain gains above $280. The support at $270 seems to have saved the bulls a trip downstream towards $260. In spite of the losses, Ether looks strong from a technical perspective. For instance, the RSI is still holding in the overbought region.

Other technical indicators such as the MACD and the Elliot Wave Oscillator reinforced the bulls’ position in the market. Therefore, the weekend session is likely to experience more action in the north. If push comes to shove, consolidation would take over with the price remaining pivotal at $270 in the coming days.

ETH/USD daily chart

%20(67)-637311795886551226.png)