EUR-USD had an exciting week with various forces influencing it. Morgan Stanley explains what’s going and what’s next:

Here is their view, courtesy of eFXnews:

In its weekly note to clients, Morgan Stanley argues that the cross-currents of negative flow dynamics and upward pressure from risk appetite may keep EUR without a clear trend in the near term.

Here are MS’ explanation for some of these cross-currents along with their structural strategy to trade the EUR over the course of their year.

4 cross-currents in play:

“First, EUR inflation rates have continued undershooting expectations. Indeed, inflation momentum itself has fallen fast in recent months, leading some to question whether the ECB’s recent stimulus efforts will be enough. Of the G4, Europe faces the slowest core inflation momentum as pointed out by our inflation strategists Global Inflation Monitor. 5 year inflation swaps have declined by almost 20bps taking inflation expectations back to levels last traded in October. Nominal rate expectations have come down in line with falling inflation rates increasing opportunity costs of holding EUR liquidity.

Second, while the ECB disappointed markets by failing to increase monthly asset purchases, it did cut interest rates even further into negative territory. We think reserve managers are particularly sensitive to negative rates as they violate the principle of capital preservation. The IMF’s latest COFER data show that reserve managers continue to bring the EUR share of their portfolios down. The start of the new year and fresh liquidity has given reserve managers a window to resume their structural diversification out of EUR.

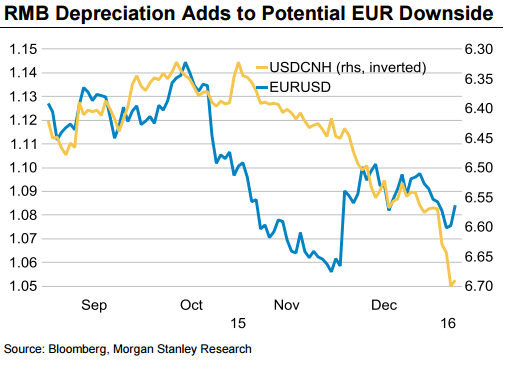

Third, the RMB has declined not only against the USD, but as well in TWI terms. This has increased global deflationary pressures where trade to China is significant and where there are open economies impacted by the evolution of global trade. EMU falls in these categories, so when the RMB moves the EUR tends to follow.

Finally, the EUR is now better suited for funding. On the funding side we differentiate between maturity neutral funding and what is widely understood as the carry trade. Carry trade funding involves investors monetising interest rate differentials but accepting maturity mismatches between generally shorter funding and longer investment time horizons. Hence carry trades are less stable than maturity-neutral funding situations,” MS clarifies.

What is the trade?

MS likes short EURJPY as a structural trade over the course of the year.

“In the the end, we would not go so far as to say that the EUR’s lower beta to risk is permanent; it has only been a few days of activity. But there are certainly structural weights on the EUR that are not apparent in JPY.For this reason our forecasts still imply another 10% of downside in EURJPY this year,” MS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.