- EUR/CHF testing key support on the 4H chart.

- Technical set up calls for further downside in the week ahead.

- Focus on Swiss Jobless Rate for fresh trading impetus.

EUR/CHF is consolidating the drop to 1.0620, posting small gains in Asia so far. The bulls look to the Swiss Jobless Rate data for the recovery to pick up momentum.

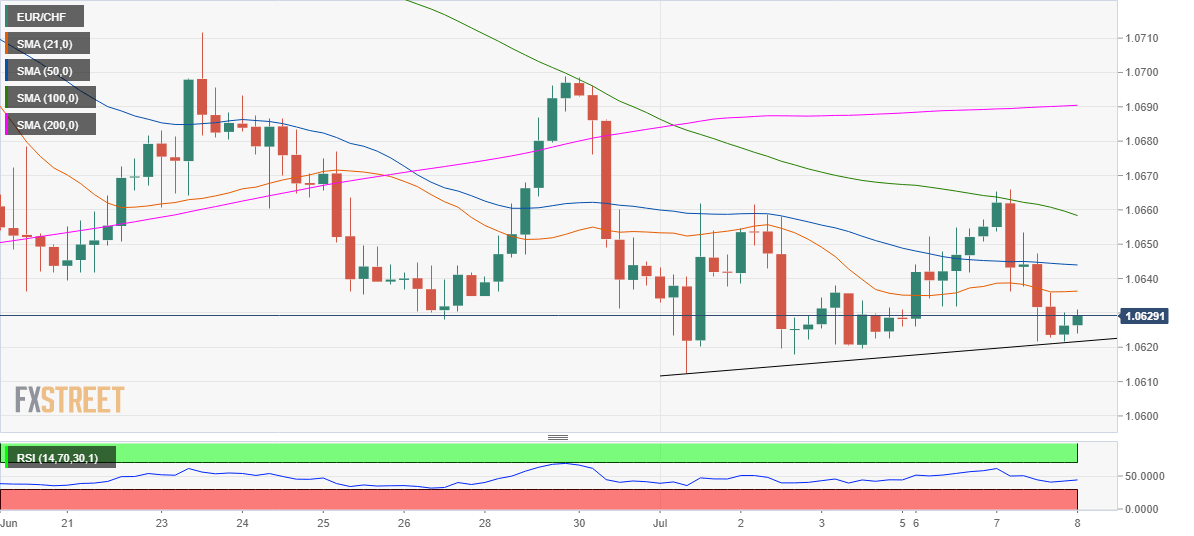

Meanwhile, the technical set up for the cross appears bearish in the coming days, as the price threatens to break the rising trend line support on the four-hour (4H) chart, now placed at 1.0620.

The bias shifted in favor of the bears after the spot cut the 21-4H Simple Moving Average (SMA) from above in Europe last session. The Relative Strength Index (RSI) trades flat below the midline, suggesting that the downside bias still persists.

Also, its worth noting that the price trades below all the major 4H SMAs while a lack of healthy support levels could call for a test of the 1.0570 levels should the aforesaid key support give way.

If the bulls manage to regain the 21-4H SMA, a test of the horizontal 50-4H SMA cannot be ruled out at 1.0644, as the cross attempts a minor pullback.

All in all, the path of least resistance appears to the downside in the week ahead.

EUR/CHF 4-hour chart

EUR/CHF additional levels