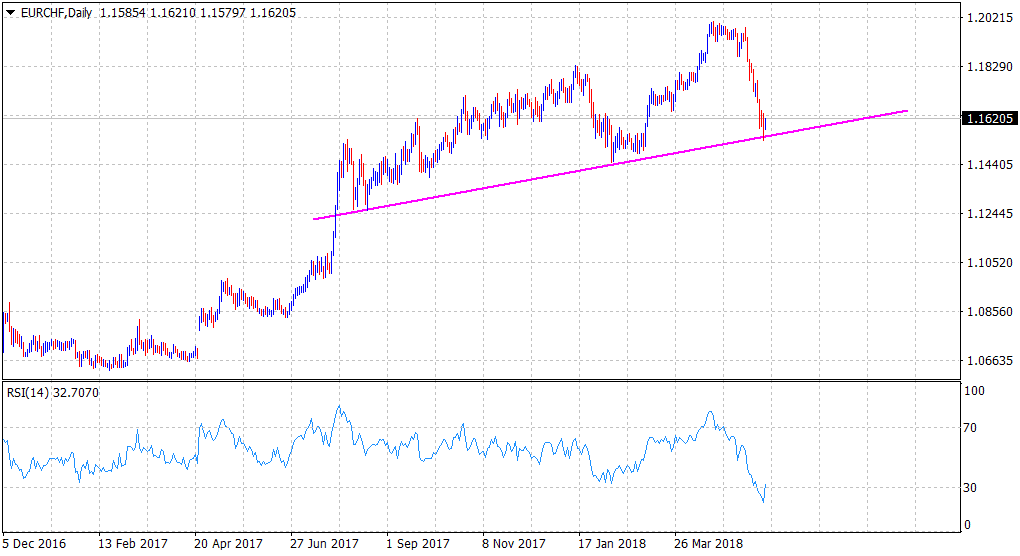

“¢ Rebound from a 10-month old ascending trend-line support.

“¢ A strong follow-through move beyond 50-hourly SMA needed for any further recovery.

The EUR/CHF cross built on the weekly bullish gap and has now reversed Friday’s steep fall to near two-month lows.

The Italian President Sergio Mattarella rejected a eurosceptic candidate for the position of Economy Minister and prompted the Prime Minister to resign.

The latest development against the anti-establishment coalition provided a much-needed respite for the shared currency and helped the cross to bounce off an ascending trend-line support, extending from lows touched in August 2017 and February 2018.

The cross also snapped four consecutive days of losing streak and is now making a fresh attempt to build on its momentum back above 50-period SMA on the hourly chart.

A sustained move would suggest that the bearish trend might be losing momentum and the cross could aim towards surpassing an intermediate barrier near mid-1.1600s (100-hourly SMA) before eventually darting towards reclaiming the 1.1700 handle (200-hourly SMA).

Alternatively, failure to build on the momentum, and a subsequent slide back below the 1.1600 handle could drag the pair back towards challenging the ascending trend-line support, currently near mid-1.1500s. A convincing break below the mentioned trend-line support would mark a fresh bearish breakdown and pave the way for an extension of the pair’s bearish trajectory.