- EUR/GBP is back above the 0.8900 level and trading in the 0.8910s after it briefly dipped below the big figure.

- If GBP continues this week’s outperformance, however, a test of key support above 0.8850 is likely.

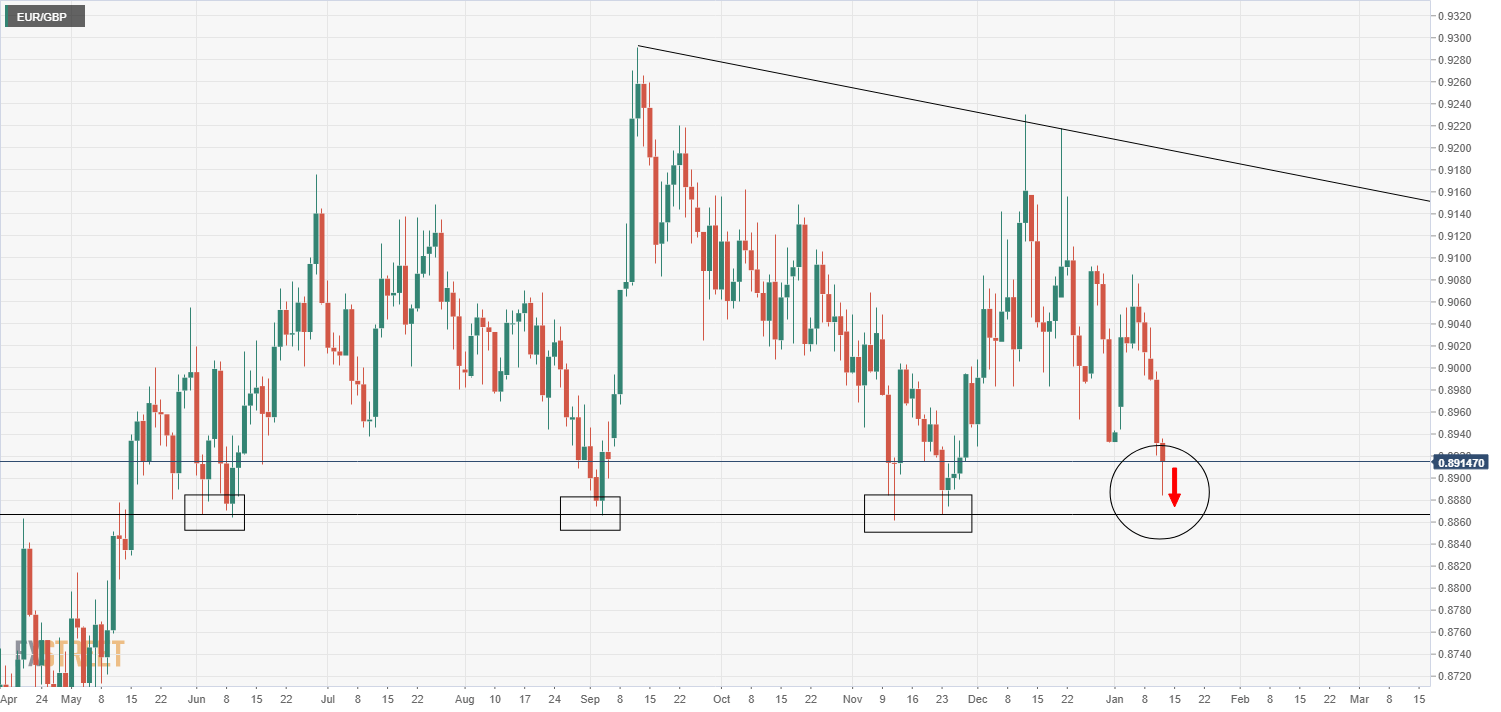

EUR/GBP is back above the 0.8900 level and trading in the 0.8910s after it briefly dipped below the big figure in recent trade and set fresh over six-week lows in the 0.8880s. On the day, the pair still trades with losses of around 0.2% or 20 pips on the day.

EUR slips versus major peers

Early in the European morning session ECB speakers were on the wires and jawboning about EUR appreciation, which does seem to have weighed upon the euro which is underperforming versus the US dollar, pound sterling and Japanese yen. ECB President Christine Lagarde said the bank would be “extremely attentive” to the impact of the exchange rate on prices, a nod to the fact that if the trade-weighted EUR continues to appreciate (thus hurting Eurozone exporters), the bank is going to be increasingly willing to implement dovish monetary policy to counter this. ECB Governing Council Member François Villeroy de Galhau also made similar comments, saying the bank is closely following the negative effects of the euro exchange rate.

Amid the proceeding dovish ECB speak, much stronger than expected Eurozone Industrial Production numbers for November were thus largely shrugged off; for reference, the MoM rate of production expansion in November was 2.5% (well above expectations for a modest increase of only 0.2%) and the YoY rate of production rose all the way back to -0.6% from -3.5% the month before. Pretty much, by November the Eurozone’s industrial sector had almost completely made up for the losses in activity incurred during the first lockdown earlier in the year. If industrial production could finish the year flat on a YoY basis, that would be quite the achievement, although with tougher lockdowns being implemented across much of the continent in the final month of the year, this might prevent that.

Further weighing on the euro might also be the fact that more EU countries are extending lockdowns; Italy has is reportedly on the cusp of extending the Covid-19 state of emergency to 30 April, following in the footsteps of the Netherlands and Germany.

EUR/GBP eyeing test of key support above 0.8850 amid GBP outperformance

GBP is the outperforming G10 currency on the week, with analysts attributing the currencies strong performance to a number of factors including; 1) money markets reducing their bets on negative rates in the UK coming months/years after BoE Governor Andrew Bailey sounding anything but keen on the policy in a speech on Tuesday and 2) on the UK’s comparatively stronger performance when it comes to distributing and administering Covid-19 vaccines versus the majority of its other developed market peers.

Though the UK government is thinking about tightening lockdown restrictions, which would present a further near-term headwind to the economy, markets appear much more focused on the optimistic story for the currency being painted by the above-noted themes. Meanwhile, the latest Covid-19 infection numbers suggest the country might be past the peak rate of spread of the virus (i.e. the December lockdown finally starting to work), which hopefully ought to take some pressure of the NHS within the coming weeks – though it is still early days and the infection rate could yet see further upside.

If GBP does continue to outperform given the above, EUR/GBP is likely to continue to the downside and a test of what has been a key area of support above 0.8850 is worth keeping an eye on. The pair was last below this level in May 2020.

EUR/GBP weekly chart