- The up move in the Sterling weighs on the cross.

- USD sell-off keeps propping up the mood in riskier assets.

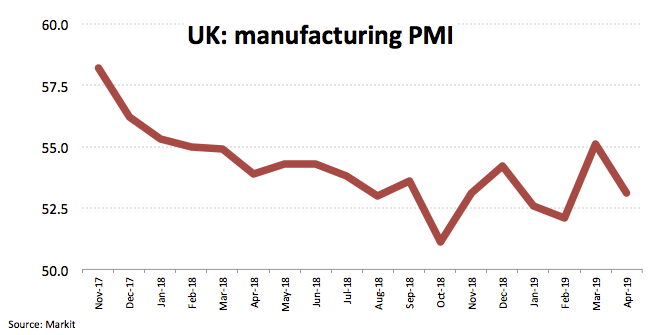

- UK manufacturing PMI came in below expectations in April.

The continuation of the bid tone around the Sterling is forcing EUR/GBP to drop below the key support at 0.8600 the figure, recording at the same time fresh 4-week lows.

EUR/GBP offered despite soft PMI

The European cross breach the key 0.8600 support today despite UK manufacturing PMI came in below expectations at 53.1 for the month of April. Additional data saw Mortgage Approvals rising below estimates by 62.34K during March.

Still in the UK docket, BoE’s Mortgage Lending and Net Lending to Individuals rose to £4.12 billion and £4.7 billion, respectively, surpassing prior surveys.

In spite of mixed-to-soft results in the calendar today, the continuation of the selling bias around the greenback remains the exclusive driver for the renewed strength in the European currency and the British Pound.

What to look for around GBP

Market participants have now shifted their focus to the upcoming local elections in the UK and ongoing cross-party talks in the Brexit negotiations. In the meantime, the absence of fresh significant Brexit headlines appears to reinforce the cautious stance around the Sterling. Recent positive data from the industrial sector and PMI were exclusively driven by companies stockpiling in case of a ‘hard Brexit’ outcome, morphing into a temporary relief for GBP although failing to allay concerns over the outlook on the UK economy and the currency in the longer run. In addition, the current steady stance from the Bank of England appears justified by below-target inflation figures, mixed results from key economic fundamentals and somewhat slowing momentum in wage inflation pressures, all adding to already rising speculations of a ‘no-hike’ this year.

EUR/GBP key levels

The cross is losing 0.17% at 0.8587 and faces the next support at 0.8502 (low Apr.3) followed by 0.8471 (2019 low Mar.13) and then 0.8430 (200-week SMA). On the upside, a break above 0.8625 (21-day SMA) would expose 0.8681 (high Apr.23) and finally 0.8722 (high Mar.21).