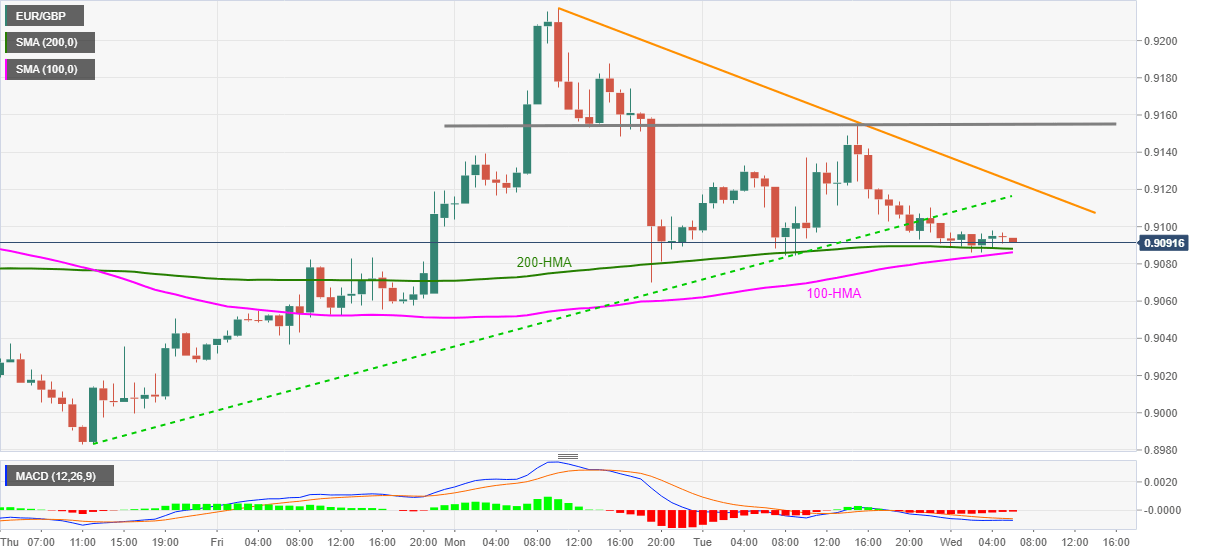

- EUR/GBP holds lower ground while keeping a downside break of short-term rising trend line.

- Weekly falling resistance line tests the bulls, bearish MACD favor sellers.

EUR/GBP wavers around 0.9090, down 0.05% intraday, while heading into Wednesday’s European open. The pair dropped below an ascending trend line from last Thursday but failed to extend the fall beneath 100 and 200-HMA.

Although strong HMAs challenge EUR/GBP sellers around 0.9088/85, bearish MACD and sustained trading below the previous support line, at 0.9115, keeps the bears hopeful.

Also acting as an upside barrier is a falling trend line from Monday, at 0.9126 now, as well as a short-term horizontal resistance around 0.9155.

Meanwhile, a downside break below the key SMAs will direct the EUR/GBP prices toward the 0.9000 round-figure before challenging the monthly low near 0.8930.

It should, however, be noted that multiple lows marked since June close to 0.8860/65 offer strong support to the pair past-0.8930.

EUR/GBP hourly chart

Trend: Further weakness expected