- EUR/GBP wavers in a choppy range, dropped to the fresh low since May 2020 the previous day.

- A nine-month-old horizontal area captivates bears, 10-day SMA guards recovery moves.

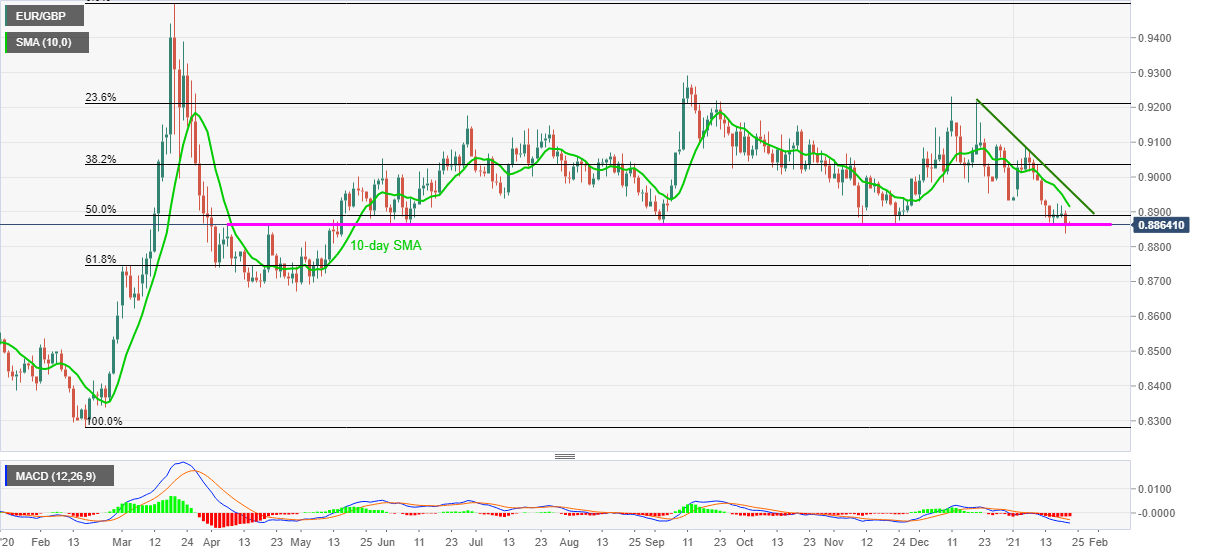

EUR/GBP seesaws in a range between 0.8860 and 0.8870, currently around 0.8865, ahead of Thursday’s European session. The quote refreshed a multi-day low on Wednesday after breaking the key support established in April 2020.

Given the EUR/GBP downside below the stated support, coupled with bearish MACD and sustained trading below short-term SMA, sellers are targeting 61.8% Fibonacci retracement of early-2020 upside, near 0.8745.

While the early May 2020 top around 0.8815 and the 0.8800 threshold can add to the downside filters, EUR/GBP will become vulnerable to visit the April 2020 lows near 0.8670 during any further downside past-0.8745.

Alternatively, 50% Fibonacci retracement level and 10-day SMA, respectively around 0.8890 and 0.8915, will probe the quote’s bounce off key support area.

Also likely to challenge the EUR/GBP buyers is a downward sloping trend line from December 21, at 0.8965 now.

Overall, the EUR/GBP remains in a bearish mood and today’s ECB can exert additional pressure onto the pair if matching wide market forecasts.

Read: ECB Preview: Lagarde may trigger a “buy the dip” opportunity by trying to talk down the euro

EUR/GBP daily chart

Trend: Bearish