- EUR/GBP consolidates recent gains despite printing mild gains on the D1.

- Corrective recovery can extend amid normal RSI conditions but lower high formation test bulls.

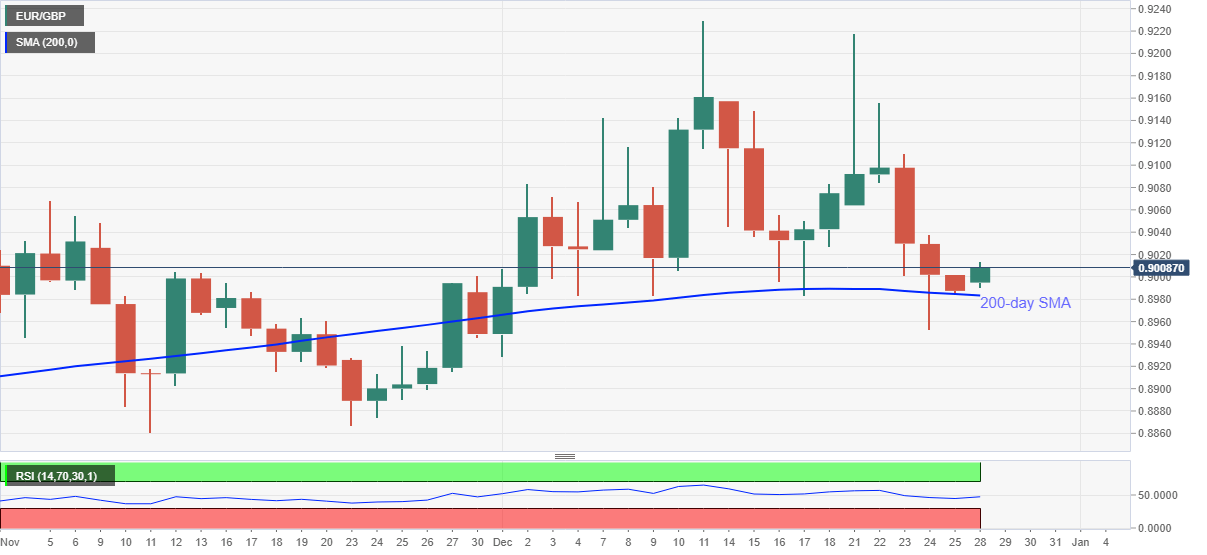

EUR/GBP wavers around 0.9000 ahead of Monday’s European session. In doing so, the quote eases from the intraday high of 0.9013 but keeps U-turn from 200-day SMA.

Considering the absence of overbought RSI conditions, coupled with the previous bounce off the key SMA, EUR/GBP is up for a fresh run-up targeting the 0.9100 threshold.

Though, lower high formation so far in the current month could challenge the buyers ahead of the 0.9200 round-figure.

It should, however, be noted that a sustained trading past-0.9200 enables the bulls to refresh the monthly top near 0.9230.

Alternatively, a downside break of 200-day, currently around 0.8983, offers the key support, for now, a break of which can direct EUR/GBP sellers toward the monthly low around 0.8930.

During the quote’s further weakness past-0.8930, the 0.8900 mark and November’s bottom near 0.8860 will be the key to watch.

EUR/GBP daily chart

Trend: Further recovery expected