- EUR/GBP gained traction for the second consecutive session on Monday.

- The momentum stalled near a short-term descending trend-line hurdle.

- Mixed oscillators warrant caution before placing aggressive bullish bets.

The EUR/GBP cross built on Friday’s modest recovery from the 0.8535-30 region, or over one-year lows and gained some follow-through traction on the first day of a new trading week. This marked the second straight day of a positive move and pushed the cross to four-day tops during the mid-European session.

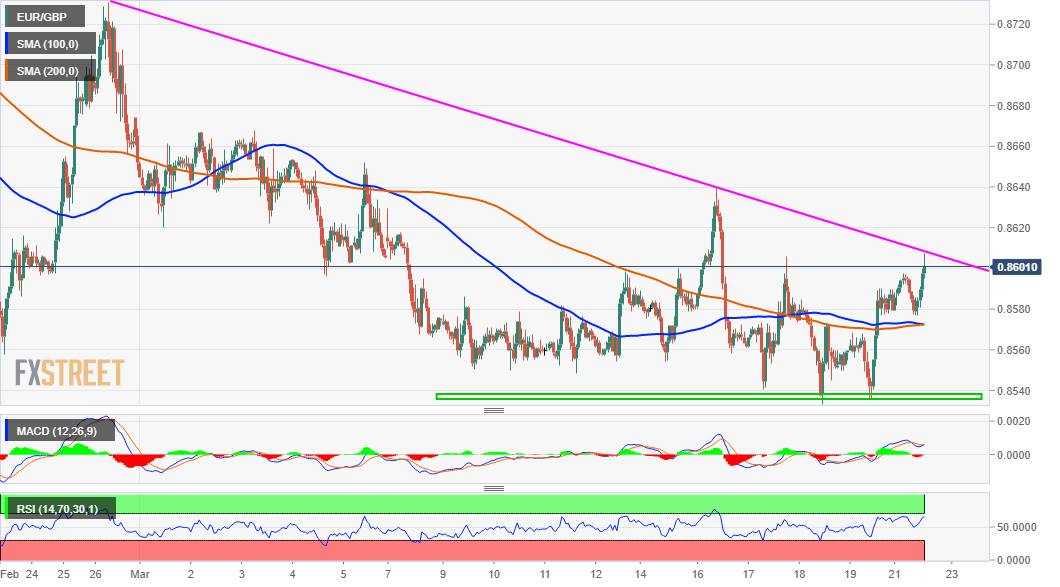

Bulls, however, seemed struggling to build on the momentum further beyond the 0.8600 round-figure mark and faced rejection near a short-term descending trend-line. The mentioned barrier extends from late February swing highs, near the 0.8730 region and should now act as a key pivotal point for traders.

Given that the EUR/GBP cross is holding comfortably above important intraday moving averages (100 & 200-hour SMA), the bias seems tilted firmly in favour of bullish traders. This, along with positive oscillators on hourly charts, supports prospects for an eventual break through the trend-line barrier.

Meanwhile, oscillators on the daily chart – though have recovered from oversold conditions – are yet to recover from the bearish territory. This makes it prudent to wait for a move beyond the trend-line resistance, currently near the 0.8610-15 area, before positioning for any further appreciating move.

On the flip side, daily swing lows, around the 0.8570 region, which coincides with 200-hour SMA, should now protect the immediate downside. Weakness back below the mentioned support will negate prospects for any further recovery and turn the EUR/GBP cross vulnerable to retest multi-month lows.

Some follow-through selling will expose the key 0.8500 psychological mark, which if broken decisively will be seen as a fresh trigger for bearish traders. This, in turn, will set the stage for an extension of the recent/well-established bearish trend witnessed over the past three months or so.

EUR/GBP 1-hourly chart

Technical levels to watch