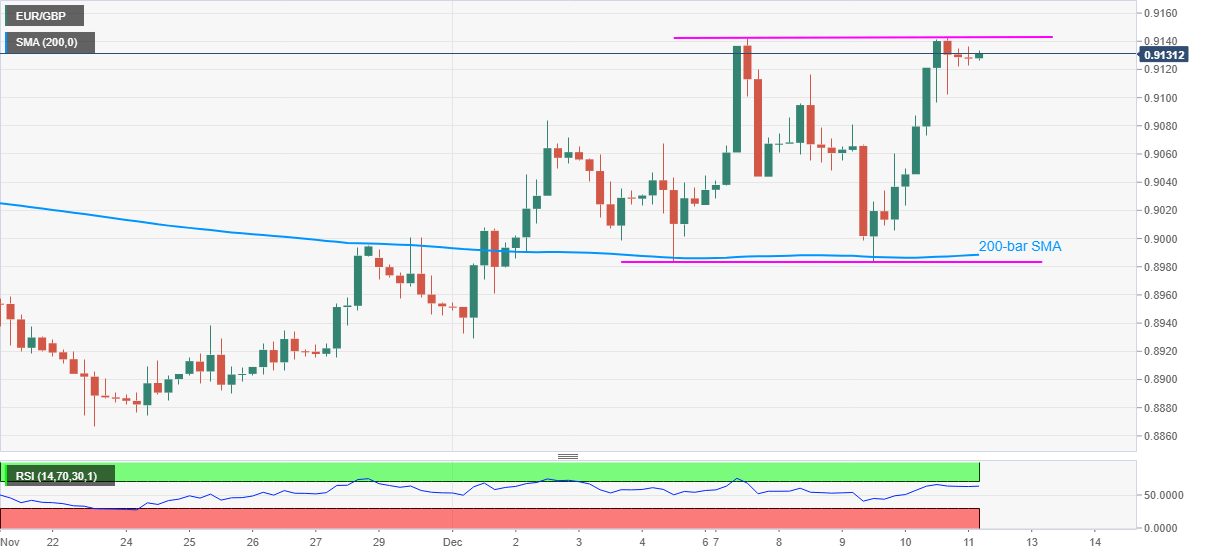

- EUR/GBP picks up bids to challenge the highs marked on Monday and Thursday.

- RSI conditions suggest pullback from the key resistance.

- Bears eye entries below 0.8983, 200-bar SMA adds to the downside filters.

EUR/GBP reverses the early-Asian losses while revisiting the 0.9131 level ahead of Friday’s European session. In doing so, the pair buyers again eye highs marked twice during this week.

Although the 0.9142 level keeps luring the EUR/GBP bulls, RSI conditions are likely to mark another failure in crossing the key resistance.

In a case where the quote surprises traders with an upside break of 0.9142, the “double bottom” bullish pattern on the four-hour (4H) chart gets confirmed, which in turn opens room for the northward trajectory towards the yearly top near 0.9290.

During the run-up, the late-September tops close to 0.9220 and the 0.9200 round-figure can offer breathing space to the EUR/GBP buyers.

Meanwhile, the 0.9100 round-figure and December 02 top near 0.9080 can entertain intraday sellers before highlighting the 200-bar SMA level of 0.8988.

It should, however, be noted that lows marked twice so far during the month near 0.8983 becomes a tough nut to crack for the EUR/GBP bears afterward.

EUR/GBP four-hour chart

Trend: Pullback expected