- EUR/GBP pushes above key 200-HMA after falling wedge breakout.

- 100-HMA, however, challenges the bulls’ commitment.

- Further upside remains on cards amid bullish RSI.

EUR/GBP is extending gains on the 0.9000 level, benefiting from bigger losses in the pound when compared to its European peers.

Broad-based US dollar strength, in the wake of rising Treasury yields and stimulus hopes, weighs heavily on most of the major G10 currencies on Monday.

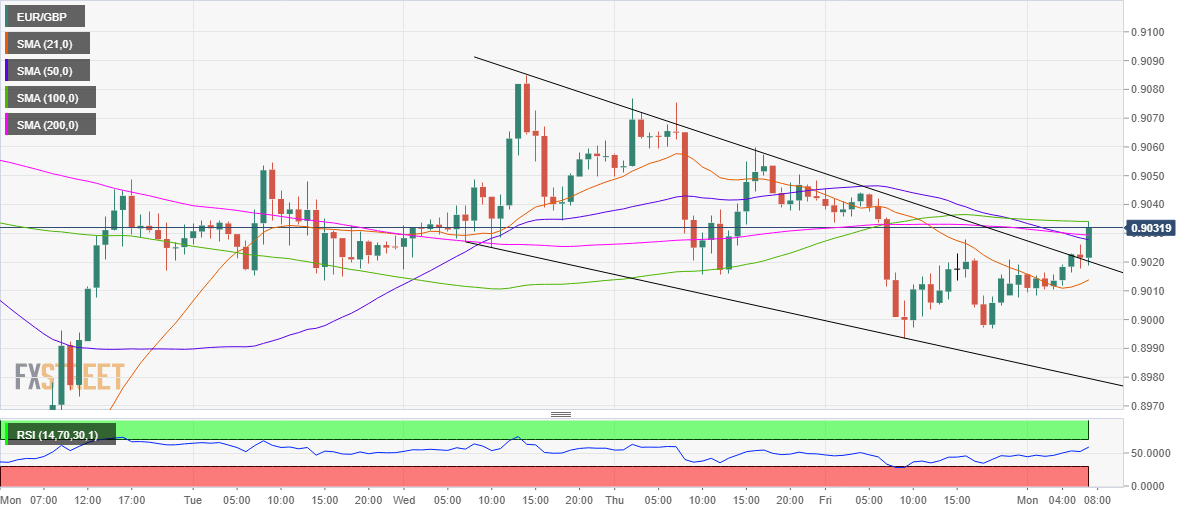

From the near-term technical perspective, EUR/GBP has broken through the falling wedge pattern, confirming an upside break.

The bulls extended control thereafter, as the price pierced above the critical resistance at 0.9028, where the 200- hourly moving average (HMA) and 50-HMA coincide.

However, the 100-HMA resistance at 0.9035 seems to be capping the immediate upside. Acceptance above the latter could open towards 0.9050 and beyond.

To the downside, the pattern resistance now support at 0.9020 could restrict any pullback, below which the 21-HMA 0.9013 could be tested.

EUR/GBP: Hourly chart

EUR/GBP: Additional levels