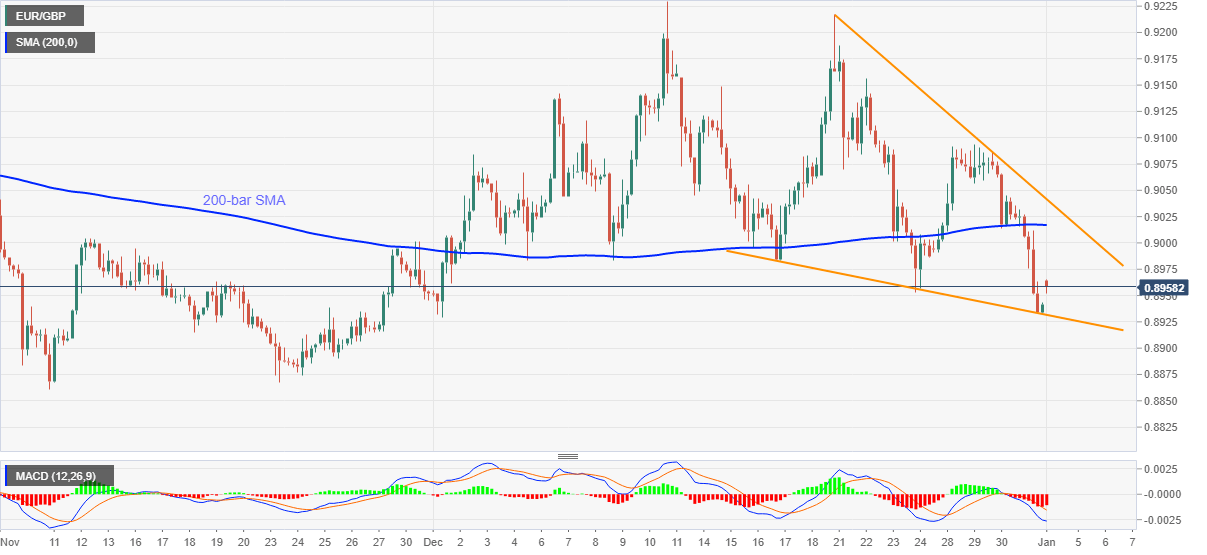

- EUR/GBP fills the week-start gap-up following the latest corrective recovery.

- 200-bar SMA offers immediate resistance inside the bullish chart pattern.

- Bearish MACD, failures to keep recent bounce favor sellers.

EUR/GBP drops to 0.8958 while fading the upside momentum from 0.8964 during the early Asian trading on Monday. The pair began the week with a gap-up but couldn’t ignore bearish MACD while staying inside a bullish formation on the hourly chart.

Hence, EUR/GBP traders are likely to be interested in the pair if it confirms bullish play or defies it. The same let them wait for an upside break of 0.9041 and sustained declines below 0.8930.

However, the latest corrective recovery from the pattern’s support near around 0.8930 eyes 200-bar SMA level of 0.9017.

It’s worth mentioning that the EUR/GBP run-up beyond 0.9017 will try hard to confirm the bullish chart pattern while eyeing December 2020 top near 0.9230.

Meanwhile, a downside break of 0.8930 may direct short-term sellers towards the 0.8900 round-figure while November 2020 trough close to 0.8860 can entertain EUR/GBP bears afterward.

EUR/GBP four-hour chart

Trend: Sideways