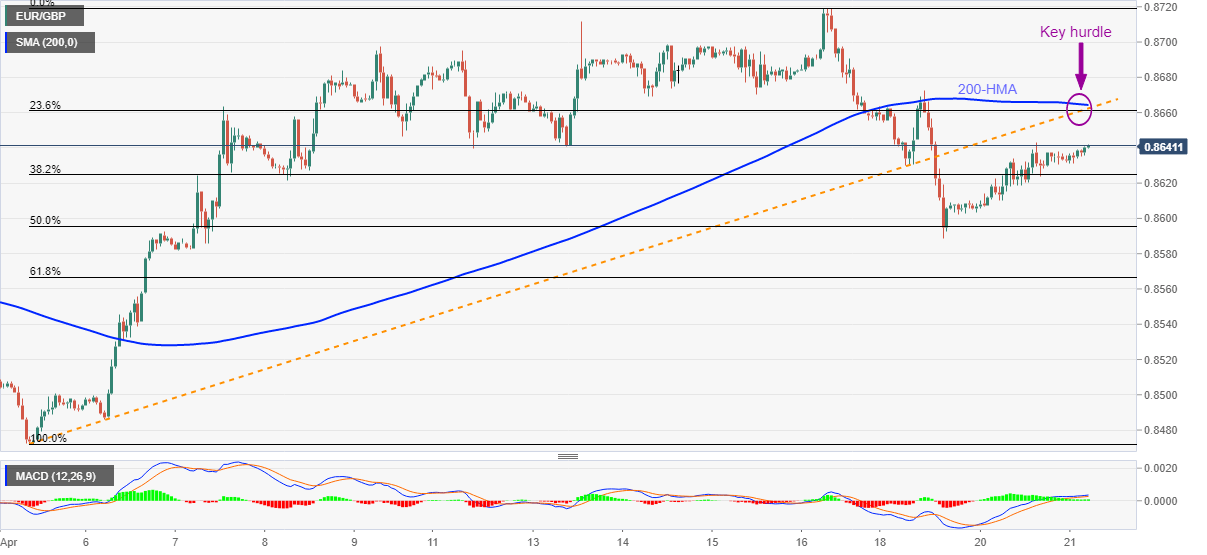

- EUR/GBP keeps the previous day’s bounce off 50% Fibonacci retracement of April 05-16 upside.

- Previous support line, 200-HMA becomes a tough nut to crack for the bulls.

EUR/GBP picks up bids to the intraday top of 0.8640, up 0.06% on a day, while heading into Wednesday’s European session. In doing so, the cross-currency pair holds onto the previous day’s U-turn from two-week lows.

While upbeat MACD backs the run-up beyond the 0.8600 threshold, a confluence of 200-HMA and the resistance line from April 05, around 0.8660-65, becomes the key hurdle to watch.

In a case where the EUR/GBP bulls dominate past-0.8665, odds of the pair’s rally to the 0.8700 round figure and the monthly top surrounding 0.8720 can’t be ruled out.

Meanwhile, pullback moves may recall the 0.8600 threshold back to the chart but any further weakness may dwindle around the latest low of 0.8588, due to the key Fibonacci retracement level.

Should the pair drops further below 0.8588, the 61.8% Fibonacci retracement level close to 0.8565 and the 0.8500 psychological magnet may entertain the EUR/GBP bears before directing them to the monthly low of 0.8472.

EUR/GBP hourly chart

Trend: Further upside expected