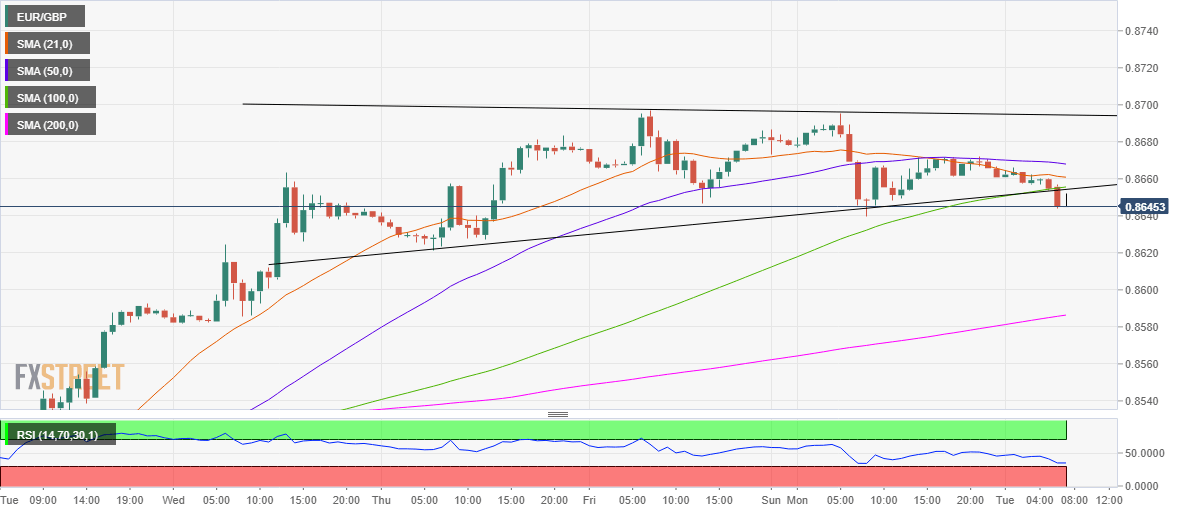

- EUR/GBP attempts a bounce after the ascending triangle breakdown on the 1H chart.

- RSI has recovered from lows but remains below the 50 level.

- Bulls are looking to regain the 100-HMA ahead of German ZEW.

EUR/GBP has stalled its decline near 0.8640 but the recovery attempts appear shallow, as the technical picture continues to paint a dour outlook.

Immediate attention turns towards the German ZEW Survey for fresh trading impetus. Meanwhile, the pair is looking to recapture the critical support now resistance at 0.8655.

The level is the convergence of the 100-hourly moving average (HMA) and the ascending triangle support.

Note that the cross confirmed an ascending triangle breakdown on the hourly chart in the last hour.

The Relative Strength Index (RSI) has reversed sharply from the lows but remains below the midline, suggesting that the bearish bias remains intact.

A failure to find acceptance above the 100-DMA resistance area could reinforce the selling pressure, with a test of the 0.8600 levels likely on the cards.

Further south, the upward-sloping 200-HMA support at 0.8586 could be challenged, below which the 0.8550 psychological level will be put at risk.

EUR/GBP: Hourly chart

However, if the recovery picks up pace, the buyers could target the horizontal 21-HMA at 0.8661.

The next upside target for the bulls is seen at 0.8669, where the 50-HMA aligns.

EUR/GBP: Additional levels