- EUR/GBP has been oscillating in a narrow trading band over the past one week or so.

- The set-up still seems tilted in favour of bearish traders, albeit warrants some caution.

- A sustained move beyond the 0.8700 mark is needed to negate the bearish outlook.

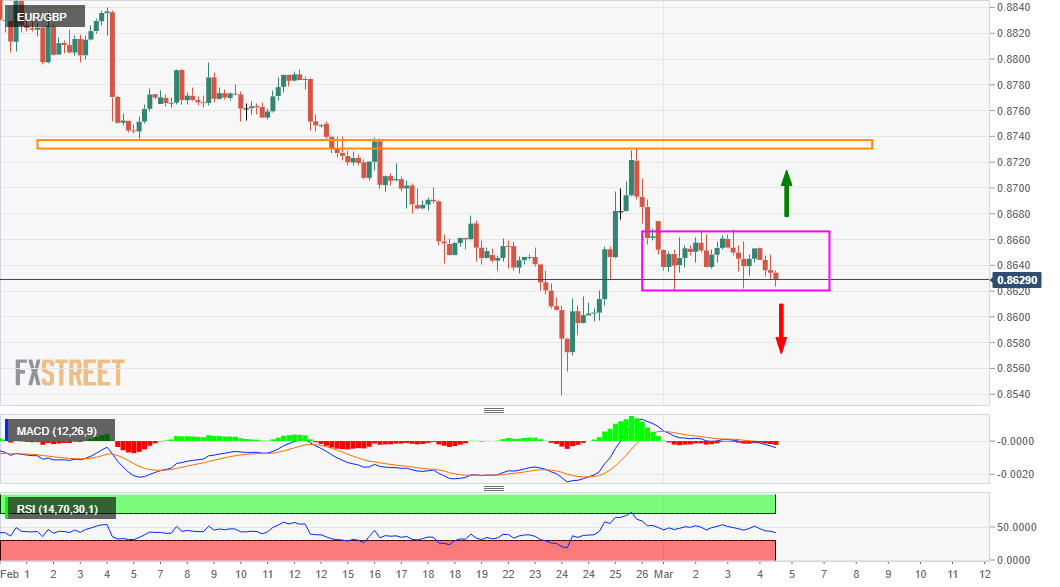

The EUR/GBP cross edged lower for the second consecutive session on Thursday and was last seen hovering near the lower boundary of its weekly trading range, around the 0.8625 region. The recent price action over the past one week or so has been confined in a narrow trading band, which seemed to constitute the formation of a rectangle on short-term charts.

A rectangle is a continuation pattern that marks a brief pause during a well-established trend. Given the recent sharp pullback from levels beyond the 0.9200 mark, the set-up favours bearish traders. The negative outlook is reinforced by the fact that last week’s attempted bounce from near one-year lows faced rejection near the 0.8700 horizontal support breakpoint.

Meanwhile, the RSI (14) indicator on the daily chart is holding closer to the 30 mark, which marks oversold conditions. This seemed to be the only factor holding traders from placing fresh bearish bets and should help limit any further downside for the EUR/GBP cross. That said, sustained weakness below the weekly trading range will mark a fresh bearish breakdown.

The EUR/GBP cross might then turn vulnerable to weaken further below the 0.8600 round-figure mark. The downward trajectory has the potential to drag the cross back towards multi-month lows, around the 0.8540 region touched on February 24.

On the flip side, the 0.8665 region now seems to have emerged as an immediate strong hurdle. A sustained move beyond might trigger a short-covering move and assist the EUR/GBP cross to make a fresh attempt towards reclaiming the 0.8700 mark. Some follow-through buying will set the stage for a further near-term recovery towards the 0.8775-80 supply zone.

A subsequent strength above the 0.8800 mark will suggest that the EUR/GBP cross has bottomed out in the near-term and pave the way for some meaningful recovery in the near-term.

EUR/GBP 4-hourly chart

Technical levels to watch