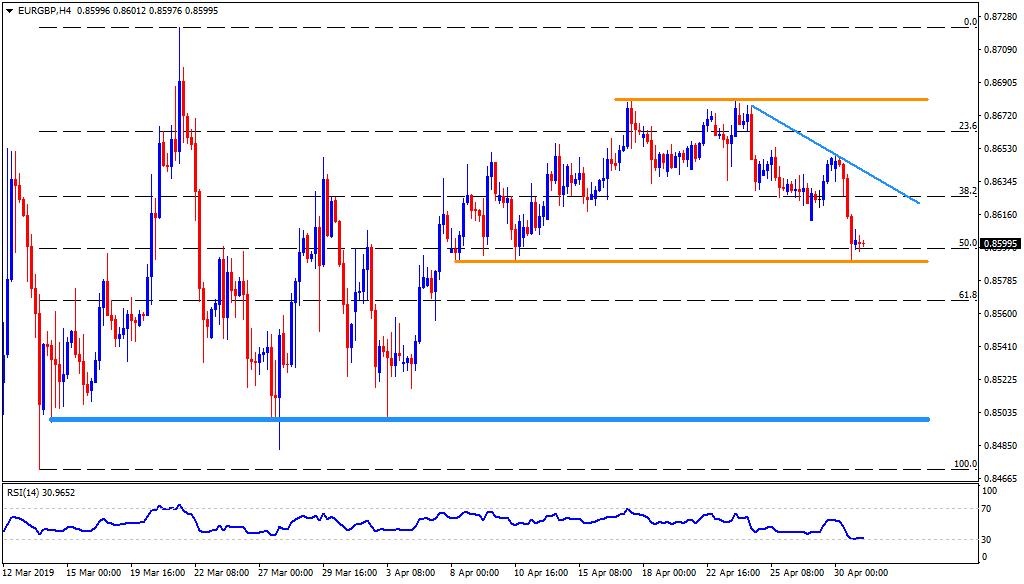

- Oversold RSI limits downside around three-week-old support.

- 0.8680 acts as a short-term important upside resistance.

EUR/GBP is trading near 0.8600 during early Wednesday. Oversold conditions of the 14-bar relative strength index (RSI) again triggered the quote’s bounce off the three-week-old horizontal support near 0.8590.

Considering the pair’s recent U-turn and RSI levels, chances of its revisit to 0.8620 and 0.8635 become brighter.

However, a weeklong descending trend-line near 0.8645/50 could question further upside, if not then 0.8665 and double tops near 0.8680 could become buyers’ favorites.

Meanwhile, pair’s decline below 0.8590 may trigger fresh downside to 0.8550 while 0.8520 and a horizontal area around 0.8500 can try limiting additional south-run.

It should also be noted that March month low near 0.8470 might lure sellers if 0.8500 fails to activate the pair’s pullback.

EUR/GBP 4-Hour chart

Trend: Pullback expected