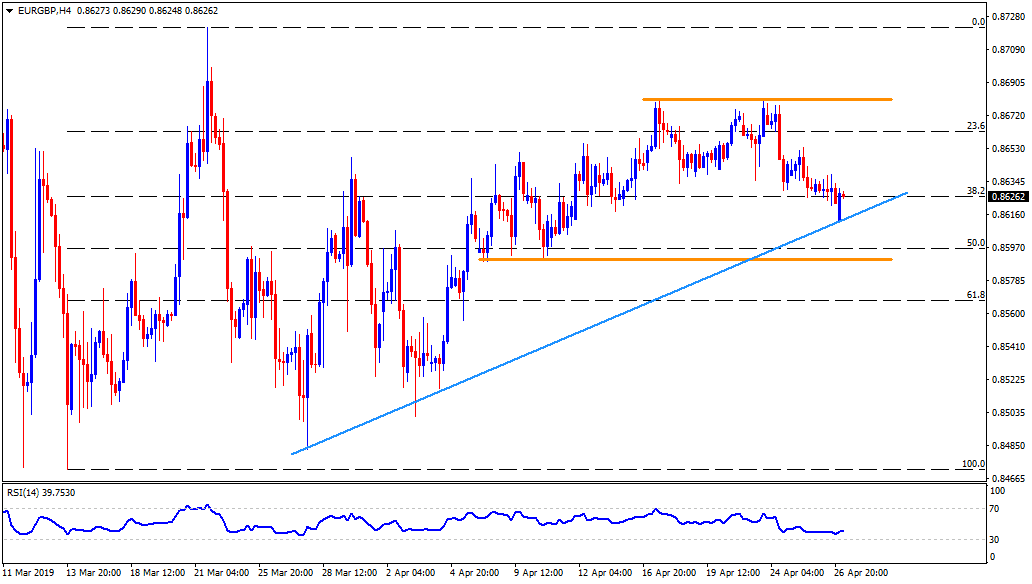

- Steady RSI and double-top near 0.8680/85 could help sellers.

- Immediate ascending trend-line and horizontal support act as a trigger for fresh selling.

EUR/GBP is taking the rounds near 0.8630 ahead of the European markets open on Monday. Considering the quote’s recent bounce off the five-week-old ascending trend-line, chances of its pullback to 0.8655 and then to 0.8680/85 double-top seems brighter.

However, the comparative strength of the British Pound (GBP) and steady 14-bar relative strength index (RSI) favor sellers if they manage to conquer 0.8610 rising trend-line and 0.8590 horizontal-line.

In doing so, 0.8550 and 0.8510 can come back on the chart whereas 0.8470 could challenge the bears afterward.

Alternatively, an upside clearance of 0.8655 may find it hard to cross 0.8685 which if takes place could quickly propel prices to 0.8700 round-figure.

Furthermore, late-March highs near 0.8725/30 might play their role of resistance after 0.8700.

EUR/GBP 4-Hour chart

Trend: Pullback expected