“¢ Reemerging Brexit worries weigh on GBP and helps regain positive traction for the second straight session and recover a part of the post-ECB slump.

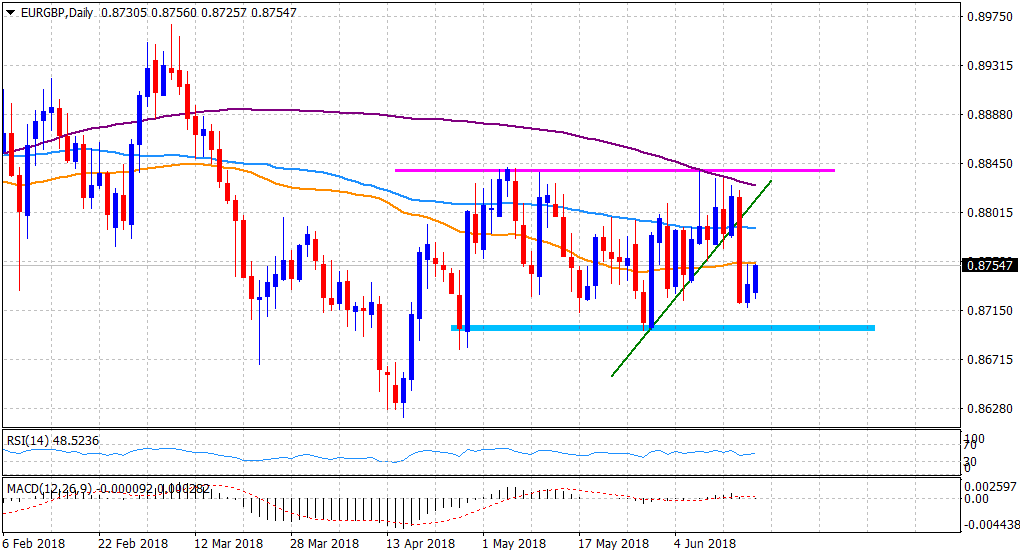

“¢ Bulls retesting 50-day SMA immediate barrier, above which the recovery could get extended back towards 100-day SMA resistance near the 0.8785-90 region.

Technical indicators hold in neutral territory and haven’t been able to suggest any firm directional bias.

Spot Rate: 0.8755

Daily Low: 0.8726

Trend: Sideways

Resistance

R1: 0.8758 (50-day SMA)

R2: 0.8779 (R2 daily pivot-point)

R3: 0.8800 (round figure mark)

Support

S1: 0.8738 (previous weekly closing level)

S2: 0.8718 (Friday’s swing low)

S3: 0.8698 (S2 daily pivot-point)