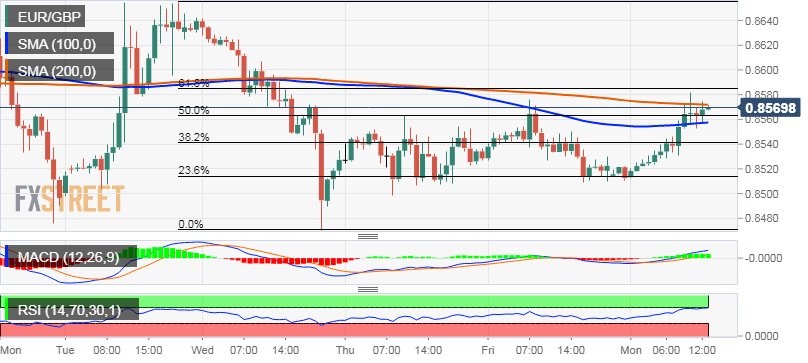

“¢ After Friday’s sharp intraday pull-back, the cross regained positive traction on the first trading day of the week and is now looking to extend the momentum beyond 200-hour SMA.

“¢ The fact that the cross managed to find acceptance above 100-hour SMA and 50% Fibo. level of the 0.8655-0.8471 slide turned out to be a key trigger for intraday bullish traders.

“¢ Bullish oscillators on the 1-hourly chart remained supportive of the up-move but are gradually moving into slightly overbought territory and might keep a lid on further gains.

“¢ Moreover, technical indicators on the daily chart are yet to catch up with the positive momentum and further warrant caution before placing any aggressive near-term bullish bets.

“¢ Hence, it would be prudent to wait for a sustained strength beyond 61.8% Fibo. level for a follow-through move beyond the 0.8600 handle towards testing the 0.8630-35 supply zone.

EUR/GBP 1-hourly chart

EUR/GBP

Overview:

Today Last Price: 0.8568

Today Daily change %: 0.54%

Today Daily Open: 0.8522

Trends:

Daily SMA20: 0.861

Daily SMA50: 0.8728

Daily SMA100: 0.8816

Daily SMA200: 0.885

Levels:

Previous Daily High: 0.8576

Previous Daily Low: 0.8509

Previous Weekly High: 0.8678

Previous Weekly Low: 0.847

Previous Monthly High: 0.8842

Previous Monthly Low: 0.8529

Daily Fibonacci 38.2%: 0.8535

Daily Fibonacci 61.8%: 0.855

Daily Pivot Point S1: 0.8496

Daily Pivot Point S2: 0.8469

Daily Pivot Point S3: 0.8429

Daily Pivot Point R1: 0.8563

Daily Pivot Point R2: 0.8603

Daily Pivot Point R3: 0.863