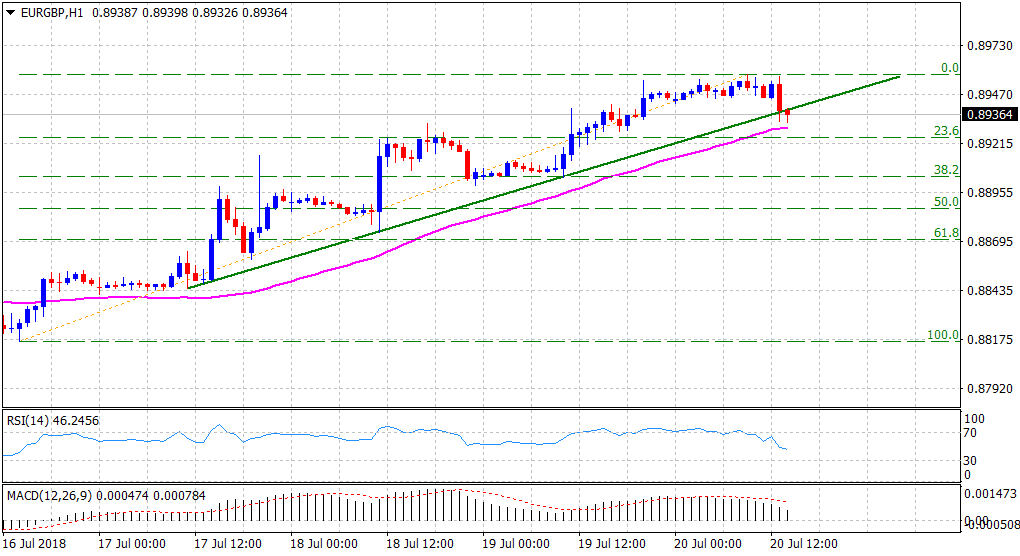

“¢ The cross struggled to build on overnight bullish breakthrough a nine-month-old descending trend-line resistance and has now snapped four consecutive days of winning streak.

“¢ The corrective fall has now dragged the pair below a short-term ascending trend-line on the 1-hourly chart, albeit bulls have managed to hold the cross above 50-hour SMA support.

“¢ A subsequent below 23.6% Fibonacci retracement level of the 0.8817-0.8958 this week’s upsurge might prompt some additional long-unwinding trade on the last trading day of the week.

Spot rate: 0.8936

Daily High: 0.8958

Trend: Short-term bearish

Resistance

R1: 0.8958 (current day swing high)

R2: 0.8989 (R2 daily pivot-point)

R3: 0.9000 (psychological round figure mark)

Support

S1: 0.8913 (9-month old trend-line resistance break-point)

S2: 0.8881 (S2 daily pivot-point)

S3: 0.8822 (200-day SMA)