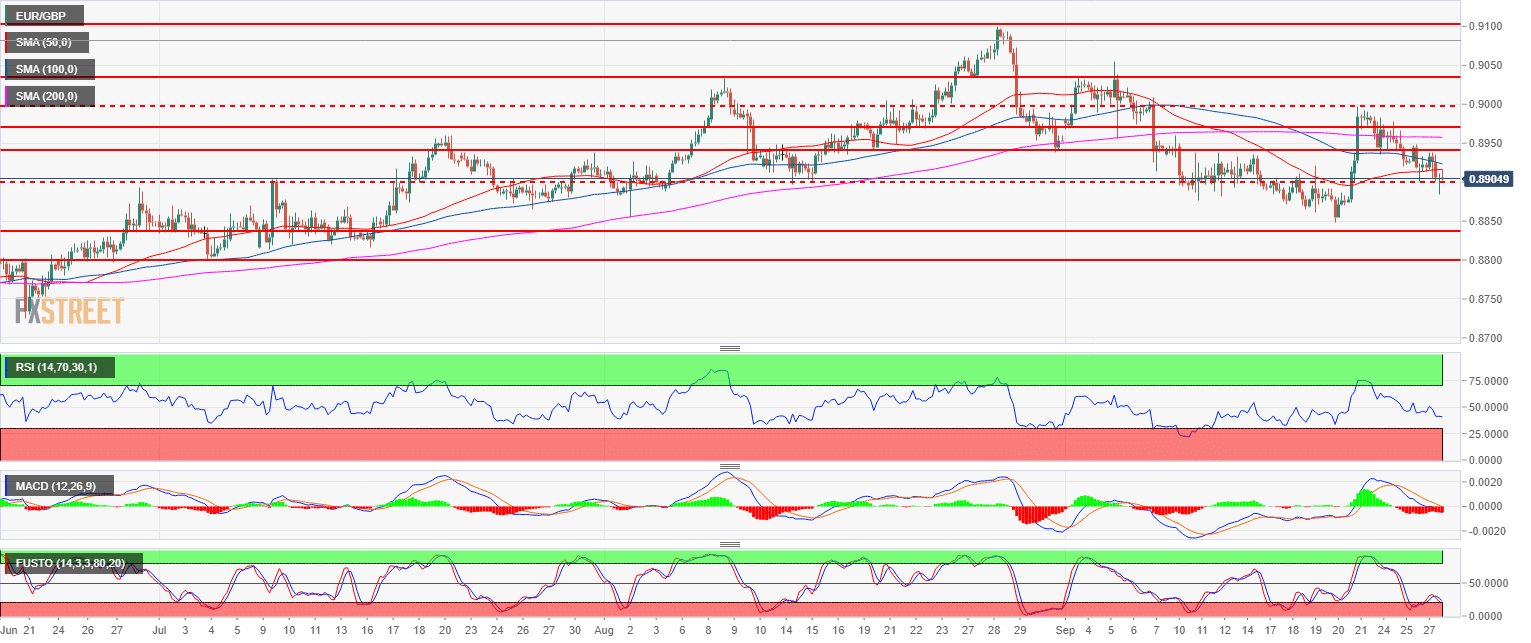

- EUR/GBP is consolidating gains as the bulls are trying to resume the main bull trend while they are finding some suppport near the 0.8900 figure.

- EUR/GBP is a having a 61.8% Fibonacci retracement from the last bull leg (Sept. 20-21 move up). EUR/GBP bulls want to resume the bull trend and their first objective is to break above 0.8940 (August 14 high) to then target 0.9000 figure.

- A bear breakout below 0.8840 would invalidate the bullish bias.

Spot rate: 0.8904

Relative change: -0.12%

High: 0.8938

Low: 0.8884

Main Trend: Bullish

Resistance 1: 0.8940 August 14 high

Resistance 2: 0.8974 September 6 low

Resistance 3: 0.9000 figure

Resistance 4: 0.9032 August 9 high

Resistance 5: 0.9100, current 2018 high

Support 1: 0.8896 August 14 swing low

Support 2: 0.8876 September 11 low

Support 3: 0.8840 key level

Support 4: 0.8800 figure