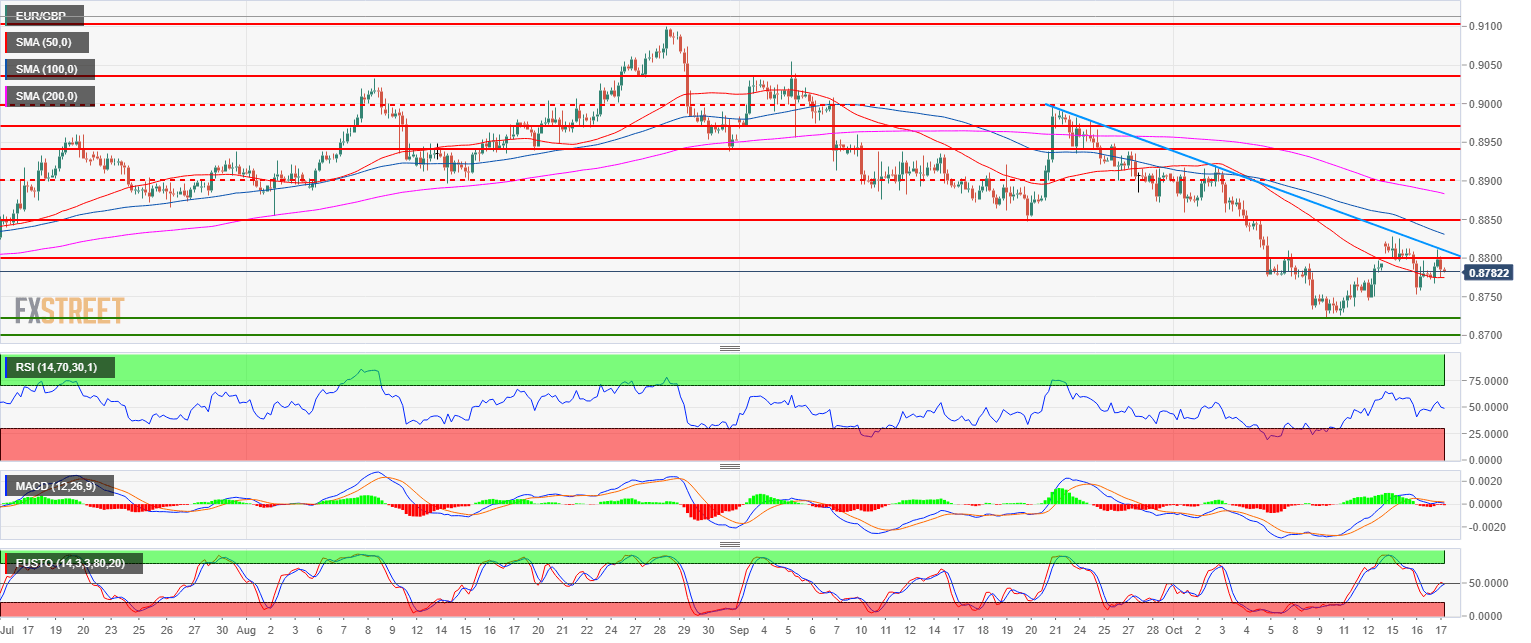

- EUR/GBP is trading in a bear trend below the 100 and 200-period simple moving average.

- EUR/GBP bulls are trying to create a bottom above the 0.8700 figure as bulls are defending the 50 SMA. The RSI, MACD and Stochastic indicators are picking up but a breakout above the 0.8800 figure and the bear trendline is needed to open the gates to 0.8900 figure.

- Alternatively, in the absence of such bullish breakout the market is set to continue to trade down.

Spot rate: 0.8782

Relative change: 0.06%

High: 0.8811

Low: 0.8767

Main Trend: Bearish

Resistance 1: 0.8800 figure

Resistance 2: 0.8847 September 20 low

Resistance 3: 0.8876 September 11 low

Resistance 4: 0.9000 figure

Support 1: 0.8764 June 8 low

Support 2: 0.8722 October low

Support 3: 0.8700 May low

Support 4: 0.8620 current 2018 low

Support 5: 0.8400 May 2017 low