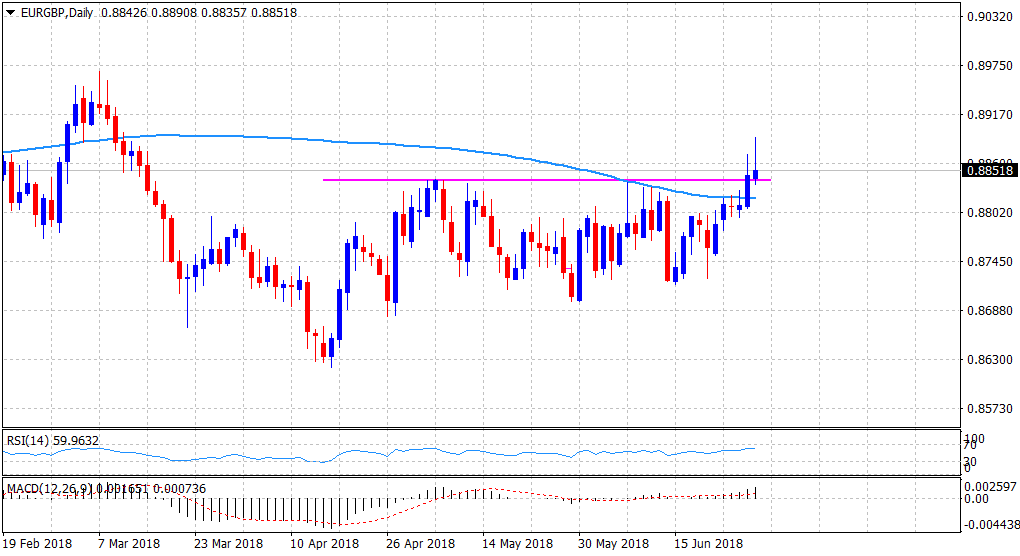

“¢ Retreats sharply from 2-1/2 month tops following an upward revision of the UK GDP print, which fueled expectations of An August BoE rate hike.

“¢ Meanwhile, mostly in-line EZ flash CPI figures helped limit further downside near an important horizontal resistance break-point now turned support.

“¢ The cross has managed to hold overnight break through the very important 200-day SMA and with short-term technical indicators sticking to a mildly positive bias, bulls seem more likely to regain their dominant position.

Spot Rate: 0.8852

Daily Low: 0.8836

Daily High: 0.8891

Trend: Bullish

Resistance

R1: 0.8891 (current day swing high)

R2: 0.8907 (R2 daily pivot point)

R3: 0.8932 (March daily closing high)

Support

S1: 0.8819 (200-day SMA)

S2: 0.8777 (S2 daily pivot-point)

S3: 0.8725 (horizontal zone)