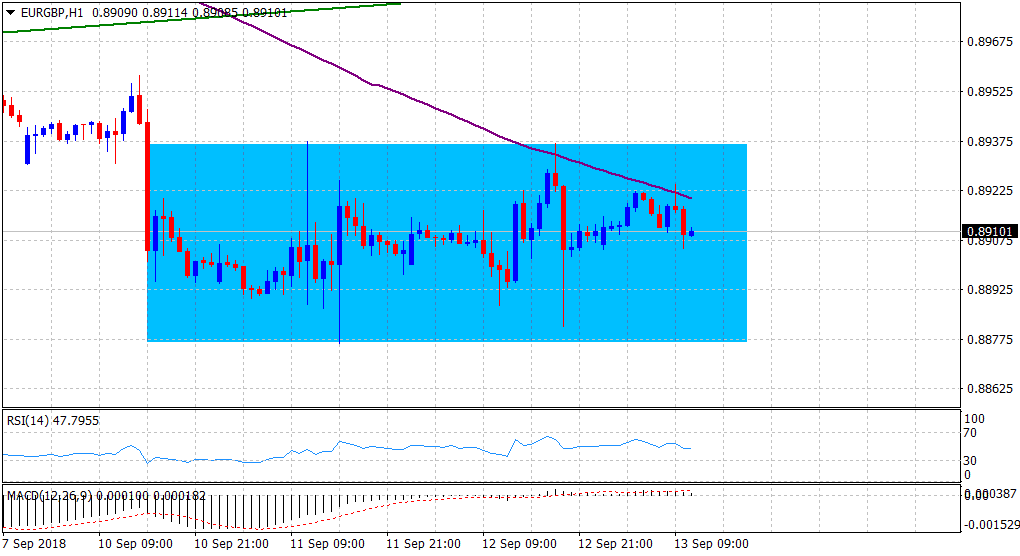

“¢ The cross extended its consolidative price action within a broader trading range, forming a triangular chart pattern on the 1-hourly chart, and remained capped at 100-hour SMA.

“¢ Neutral technical indicators on the mentioned chart have also failed to support any firm directional bias ahead of today’s key event risks – BoE and ECB monetary policy decisions.

“¢ Hence, it would be prudent to wait for a convincing break through a three-day-0ld trading range before traders start positioning for the pair’s next leg of directional move.

Spot Rate: 0.8910

Daily Low: 0.8905

Daily High: 0.8924

Trend: Range-bound

Resistance

R1: 0.8921 (current day swing high)

R2: 0.8937 (trading range hurdle)

R3: 0.8967 (R2 daily pivot-point)

Support

S1: 0.8876 (over 1-month low set on Tuesday)

S2: 0.8854 (S2 daily pivot-point)

S3: 0.8836 (200-day SMA)