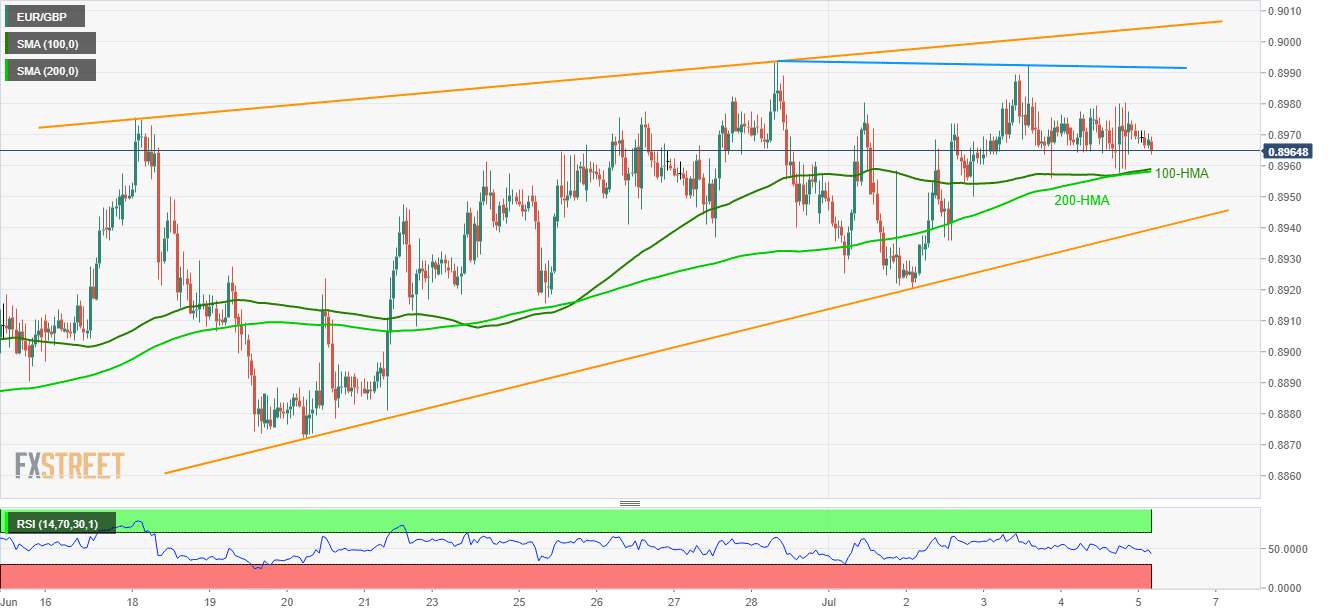

- Repeated failure to cross the 0.9000 mark, declining RSI drag the EUR/GBP pair downwards.

- Key HMA confluence and a multi-day long rising wedge formation’s support could question bears.

Following its multiple failures to rise past-0.9000 psychological mark, the EUR/GBP declines to 0.8965 ahead of the Europe open on Friday.

100 and 200-hour moving averages (HMA) can limit the pair’s nearby downside around 0.8960/55, failing to which can drag the quote to the technical pattern’s support-line of 0.8940.

However, pair’s decline below 0.8940 confirms the bearish formation indicating a plunge towards 0.8820 with 0.8920 and a late-June low around 0.8870 likely being intermediate halts during the south-run.

Adding to the quote’s weakness could be declining levels of 14-bar relative strength index (RSI).

On the upside, 0.8980 and 0.8990 can entertain buyers whereas the formation resistance-line of 0.9005 can validate the pair’s run-up towards January 11 high near 0.9065.

EUR/GBP hourly chart

Trend: Bearish