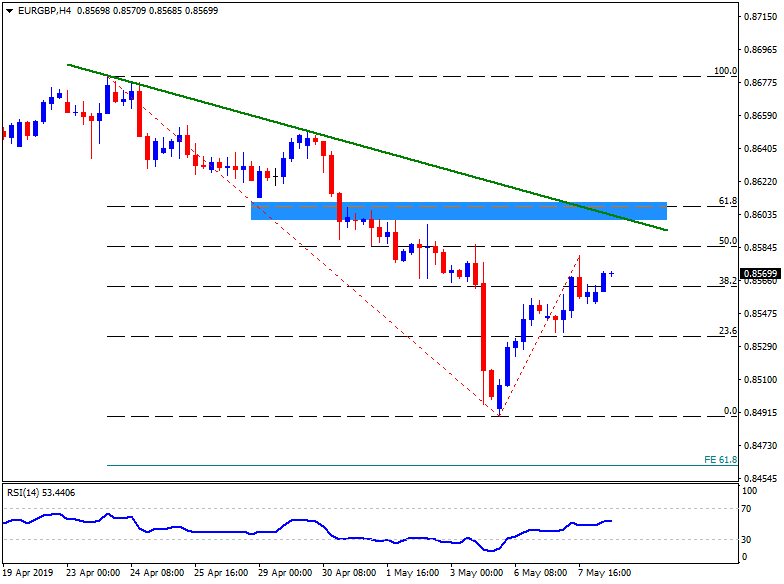

- 61.8% Fibonacci retracement and a fortnight old descending trend-line challenge buyers.

- Gradually improving RSI shows momentum strength.

The EUR/GBP is taking the rounds near 0.8570 ahead of the UK markets open on Wednesday.

While gradual recovery of 14-bar relative strength index (RSI) portrays the quote’s strength, two-week-old downward sloping trend-line and 61.8% Fibonacci retracement of its April 23 to May 06 limits the pair’s upside around 0.8600/10.

Should prices rally beyond 0.8610, 0.8650 and 0.8680 could quickly appear on the bulls’ radar.

Meanwhile, 0.8555, 0.8530 and 0.8510 can entertain short-term sellers ahead of questioning them with current month lows near 0.8490.

If at all there prevails additional downside under 0.84190, 61.8% Fibonacci expansion (FE) near 0.8460 can lure the bears.

EUR/GBP 4-Hour chart

Trend: Pullback expected