- EUR/JPY bears lurking as price stalls at fresh highs.

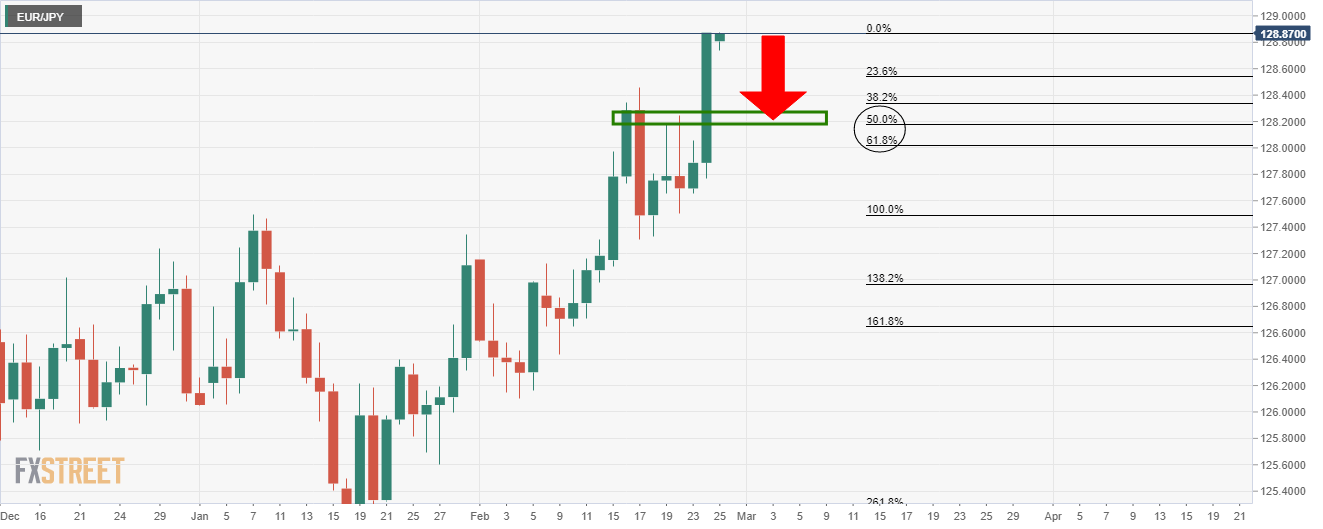

- W-formation on the daily time frame raises a bearish bias for the near term.

As per the analysis from the New York session, EUR/JPY Price Analysis: Bullish daily impulse reaches measured Fibo target, the price has indeed extended to the upside slightly following a test of old resistance.

Meanwhile, however, the W-formation on the daily chart is a bearish pattern and the price would be expected to correct to the neck line’s resistance which has a confluence of a 50% mean reversion of the bullish impulse.

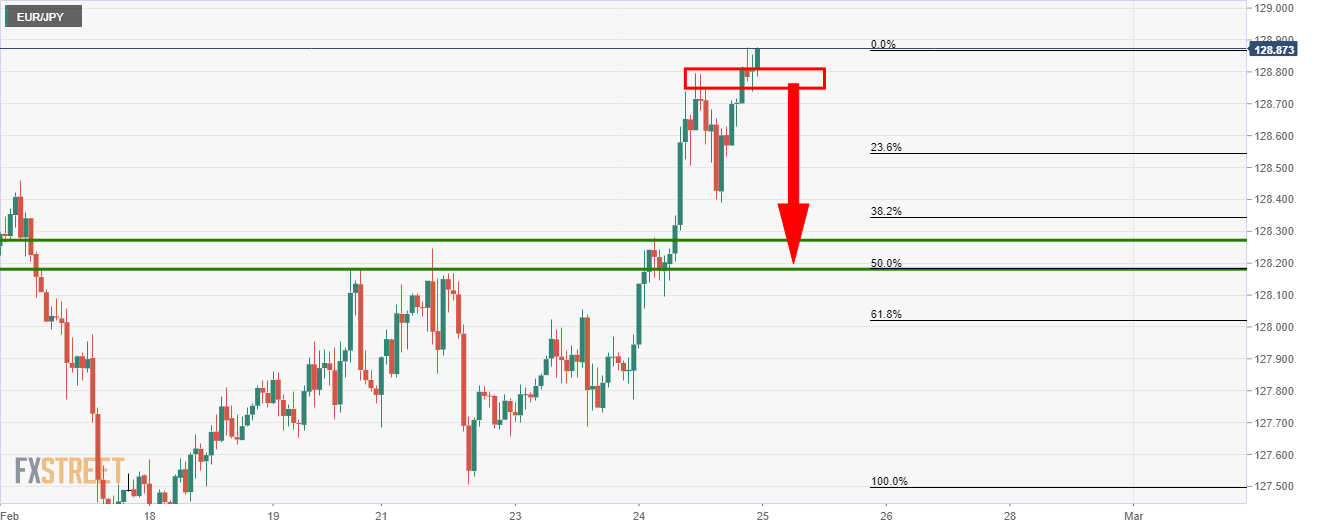

Daily chart

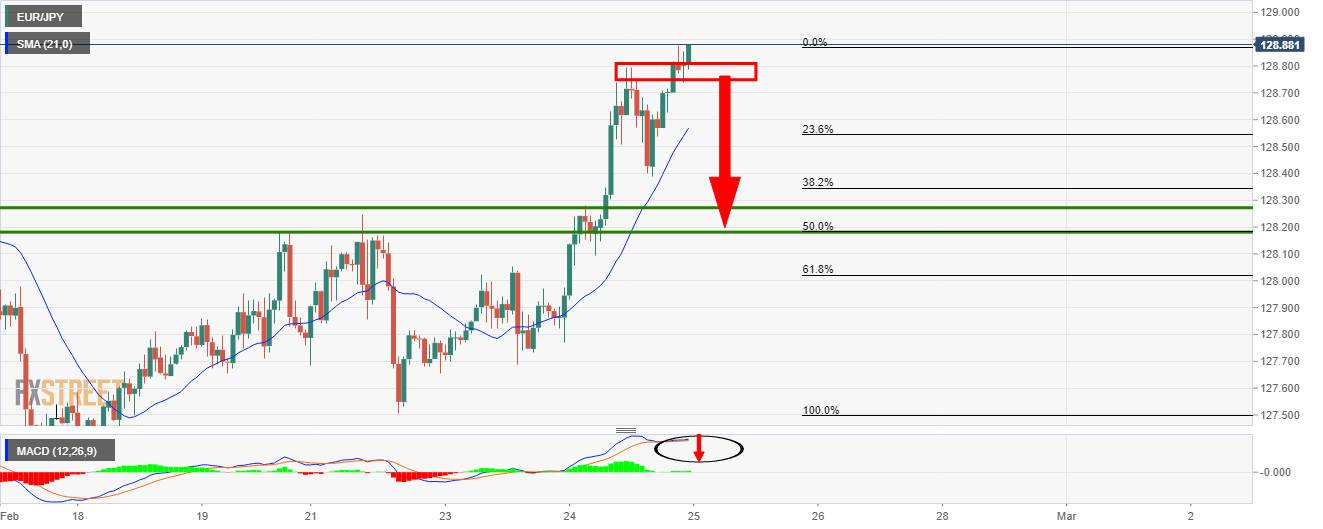

Hourly chart

The price needs to break below the support structure and developed a bearish structure from a lower time frame’s perspective, such as the hourly chart.

Conditions from a technical perspective will also need to be bearish with MACD below zero and the price below the 21 simple moving average.