- EUR/JPY is on the verge of a downside correction.

- Bears seeking an upside continuation on the longer-term charts.

The price of EUR/JPY has stalled and the downside is compelling in the short term.

The following is a topdown analysis that illustrates where the next opportunity could arise in a daily Fibonacci retracement.

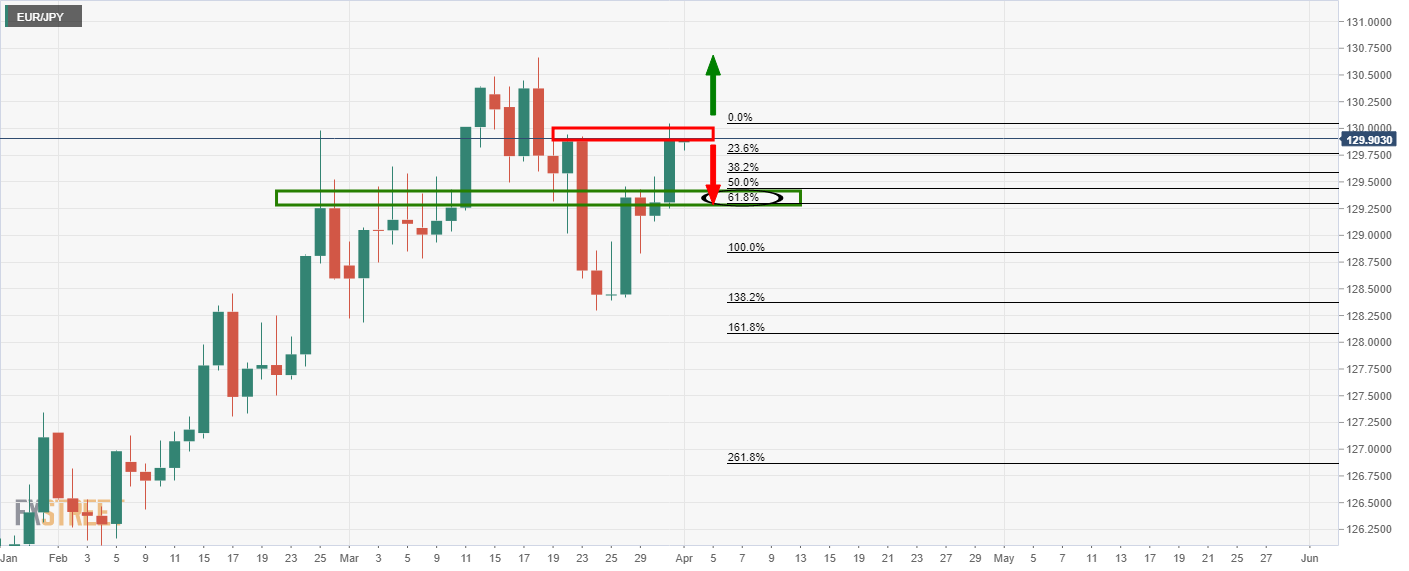

Daily chart

As seen, there is a perfect 61.8% Fibonacci confluence with the prior resistance.

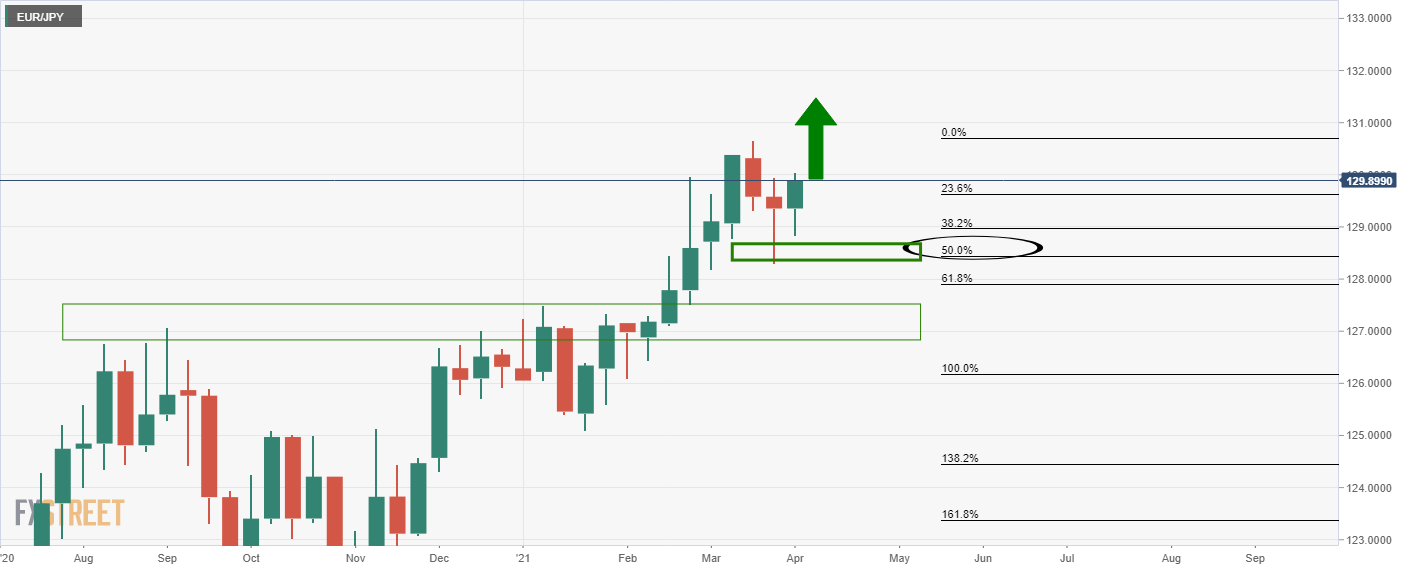

Weekly chart

However, there are bullish prospects on the weekly chart given that the price has already tested the downside and the bulls are in a potential weekly continuation to the upside.

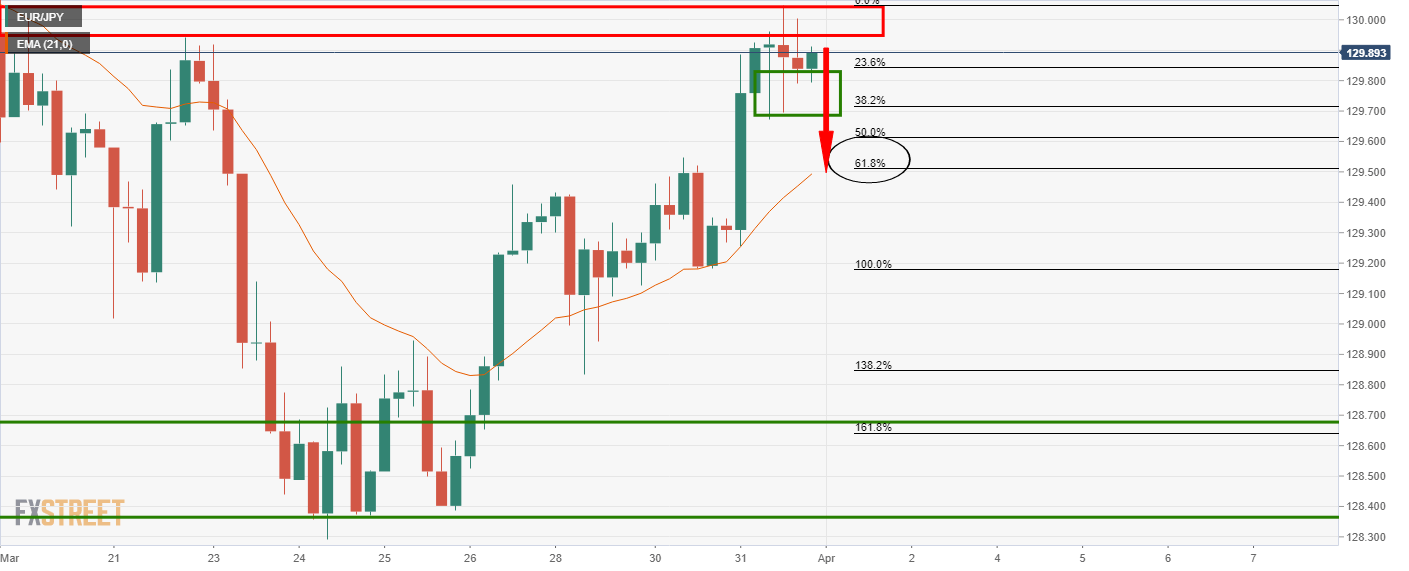

4-hourly chart

That being said, the conditions are ripening on the lower time frames for a short.

The price needs to get below the recent support structure.

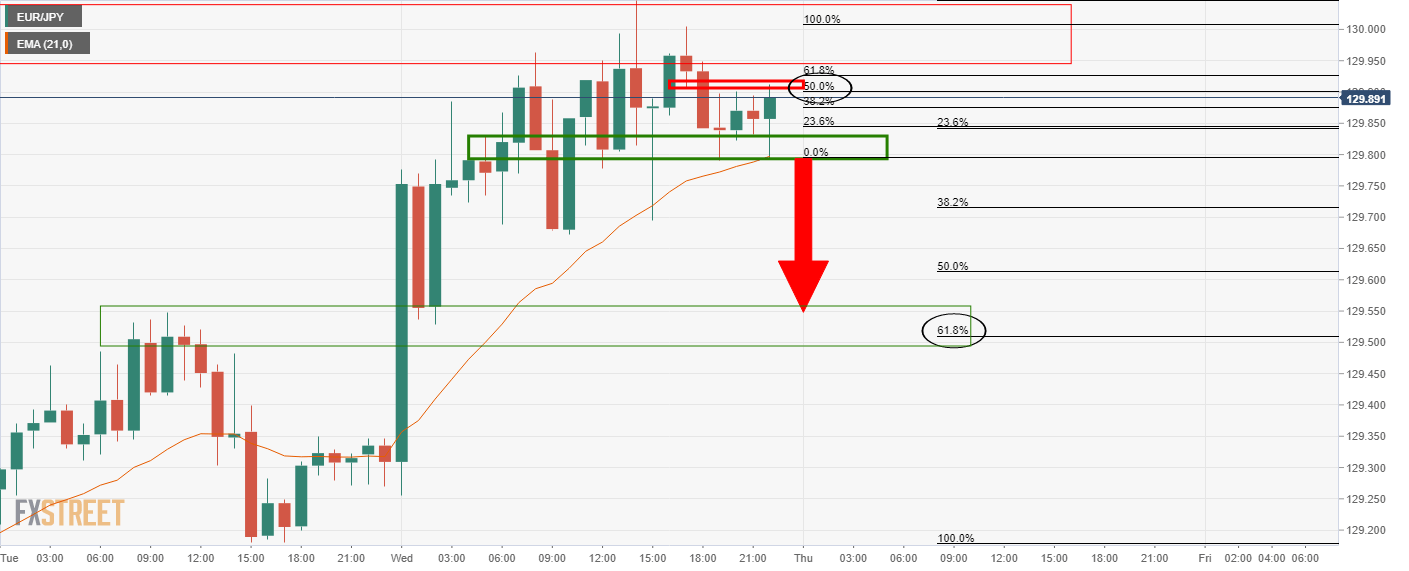

Hourly chart

This is more evident from a lower vantage point which illustrates clearly that on the failure of near term hourly resistance there will be prospects of a meaningful correction towards daily support.