- EUR/JPY bears are lining up to take on the daily support structure.

- The bears are rejecting the daily correction at a significant layer of resistance and confluence between structure and Fibos.

EUR/JPY’s downside case is compelling as traders step away from the euro which is plagued by the coronavirus fears.

The yen is a safe haven play and the technicals in the cross are bearish from both a long-term and near term perspective.

The following is a top-down analysis that illustrates where the path of least resistance is for a downside continuation of the broader bear trend.

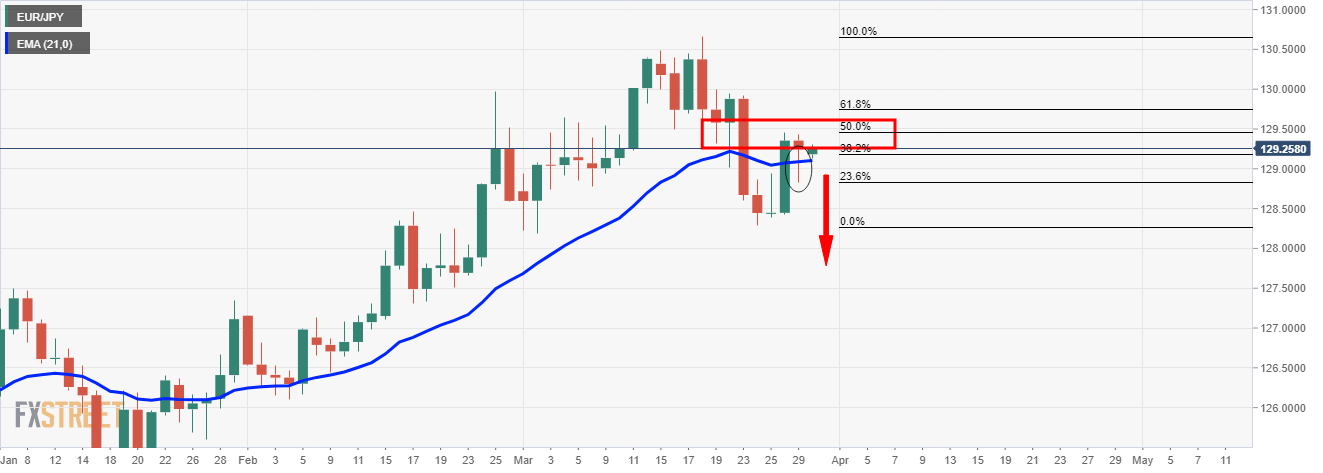

Daily chart

The path of least resistance is to the downside judging by the price action on the daily chart.

The price has corrected a significant portion of the latest daily impulse and the old support would be expected to continue to act as resistance.

The price is yet to break the 21-day EMA though.

That being said, the daily wick on the last daily bearish candlestick is compelling for a restest of the downside from lower time frames to fill in the wick.

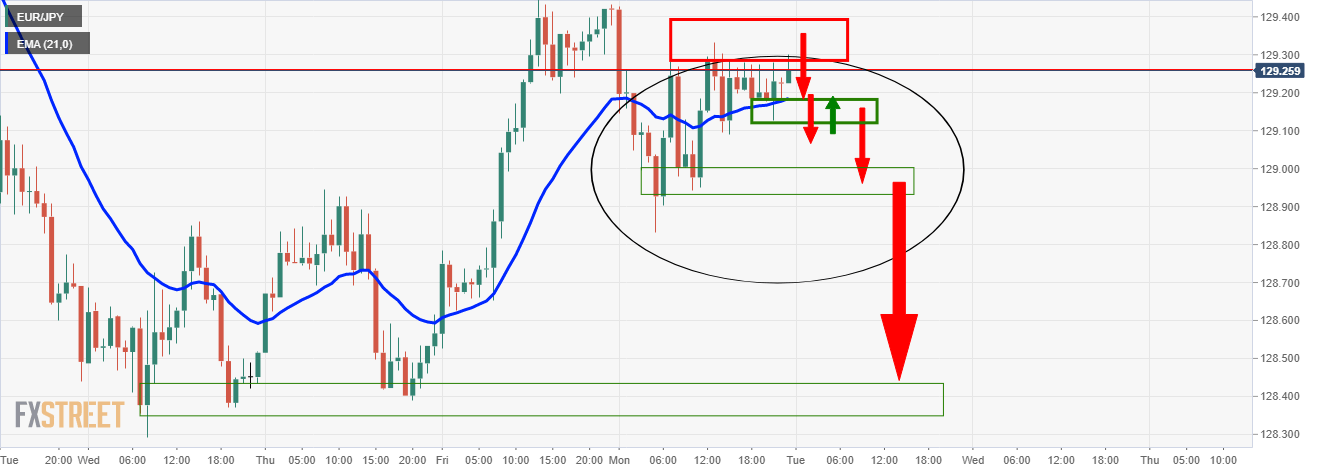

1-hour chart

Meanwhile, from an hourly perspective, on a break of initial support, the bears will face the next layer of the support structure, which, however, is expected to give way to longer-term forces and reveal the daily chart’s recent lows which will be the real test.