- EUR/JPY bears are stepping in on the daily chart to target prior resistance.

- The W formation offers a compelling case for the downside so long as 4-hour resistance holds.

EUR/JPY is ripening for a move to the downside and the following top-down analysis illustrates where traders might be taking their cues from the current market structure and price action:

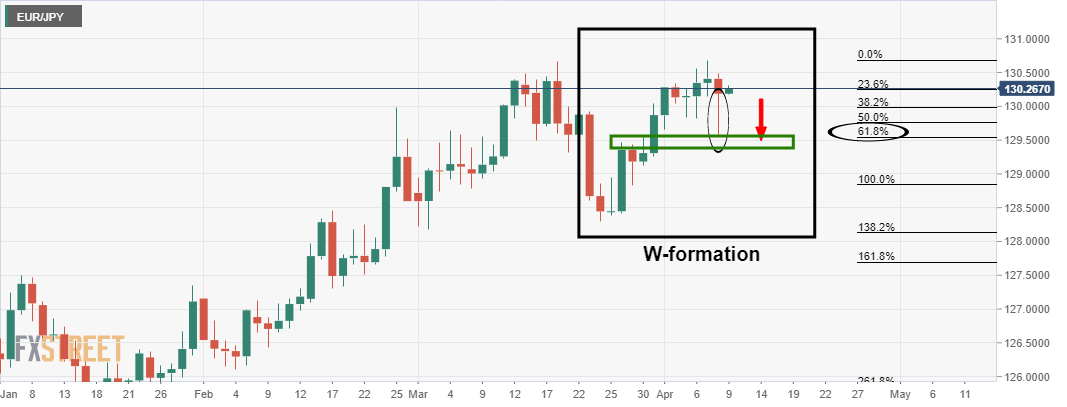

Daily chart

As seen, the W-formation is yet to complete a downside correction of the daily bullish impulses.

A test of the prior resistance would have a confluence with the 61.8% Fibonacci retracement of the upside advance and range.

The bearish candle’s close has left a wick that would be expected to be filled in on the lower time frames in bearish price action.

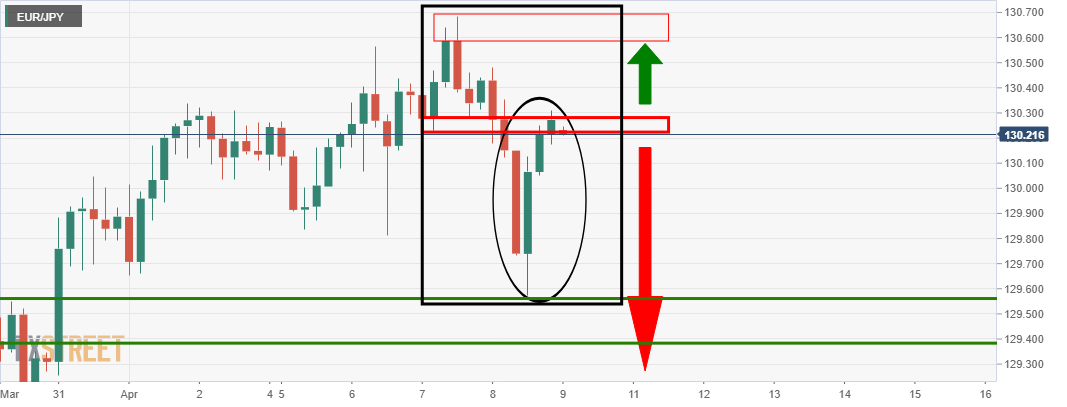

4-hour chart

From a 4-hour perspective, there is an M-formation where the correction has already met the neckline of the formation.

This adds additional conviction to the bearish prospects so long as the resistance holds and we see subsequent negative price action and bearish structure formed below the structure.

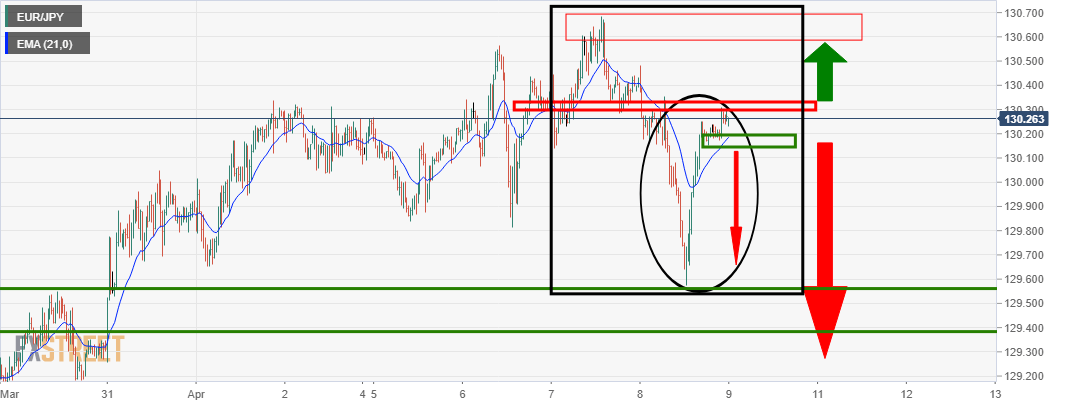

30-min chart

From a lower time frame, an optimal entry point could be established from below current support and a 21 EMA as per the 30 min chart: