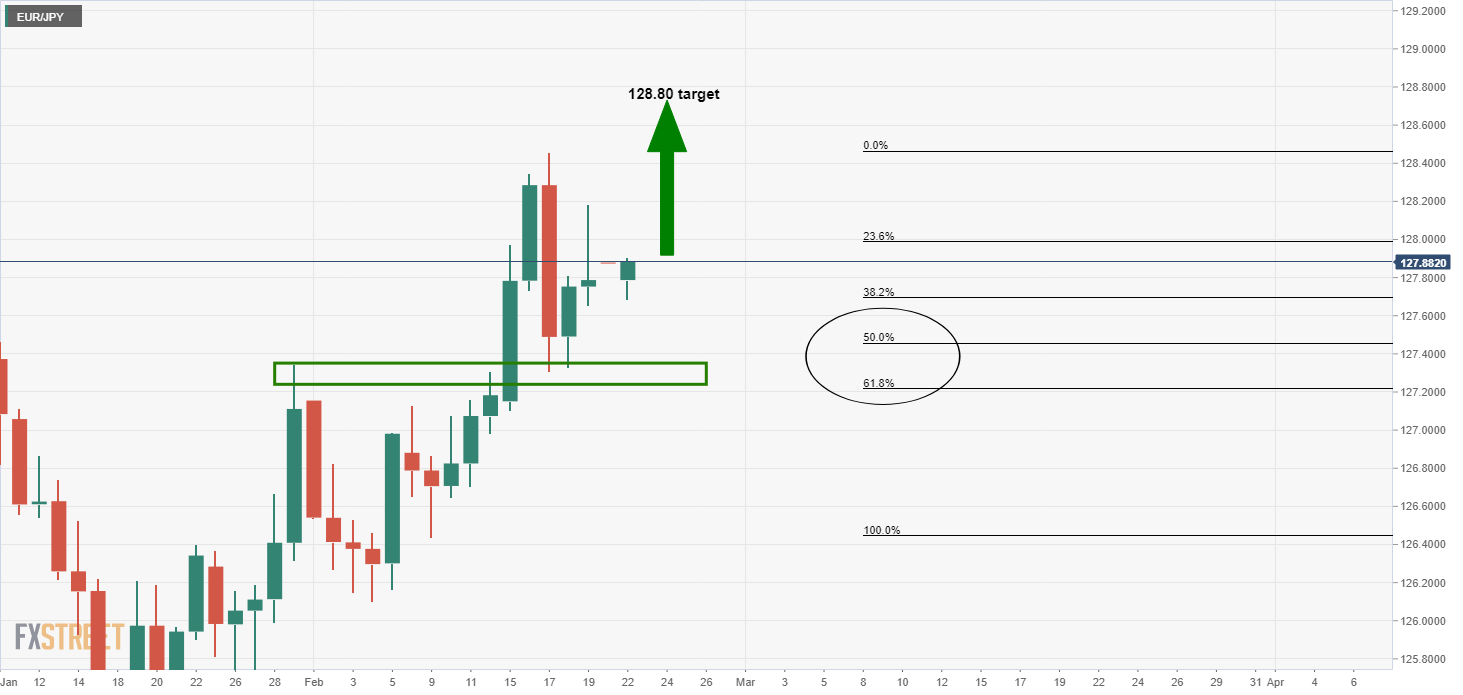

- EUR/JPY is on the verge of a significant upside extension according to the daily chart’s analysis.

- 128.20s are on the cards for a firm 4-hour closing high.

As per the prior analysis on EUR/JPY within this weeks, The Watch List: Gold, USD/JPY, AUD/USD, EUR crosses and many more, the cross has indeed moved higher.

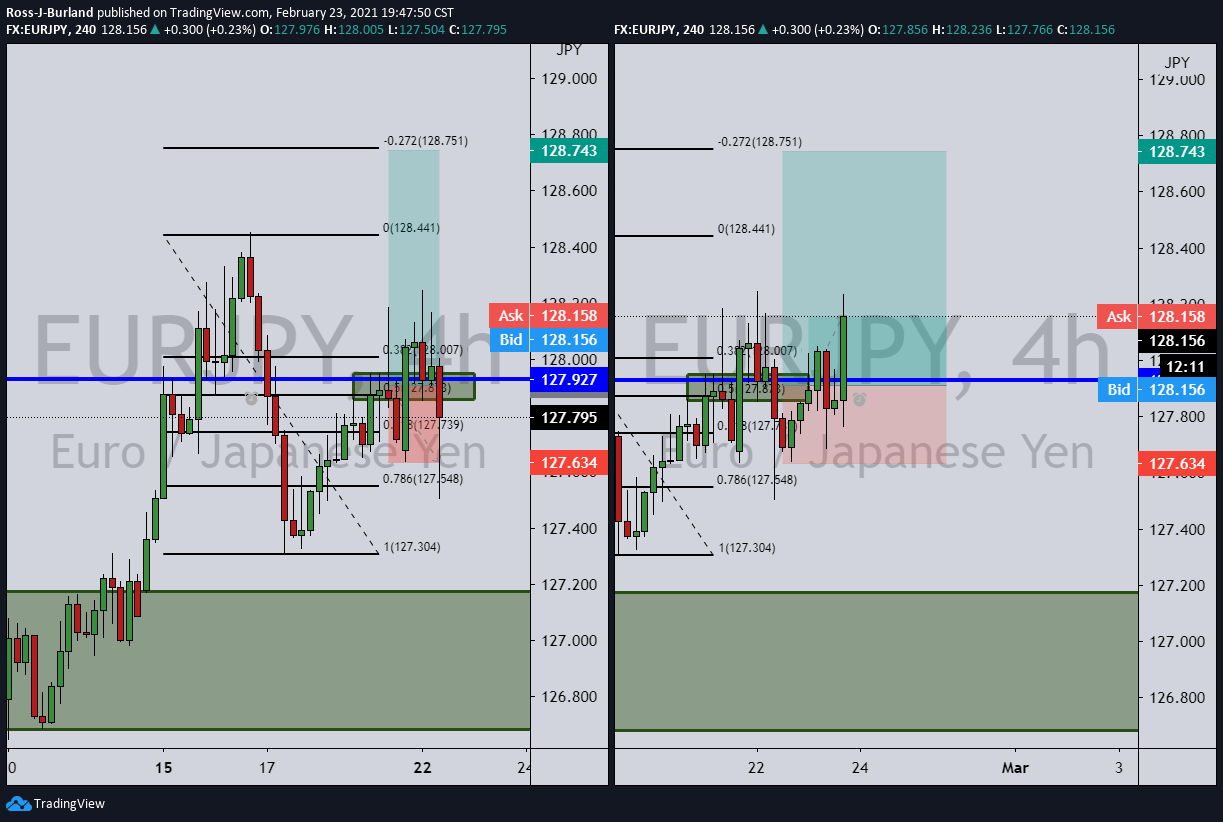

On a first failed attempt, EUR/JPY has finally moved into a positive position on a second attempt where the proposed trade set up’s stop loss can be moved to the breakeven point at the close of the 4-hour candle at the top of the hour.

Prior analysis

EUR/JPY, swing trading

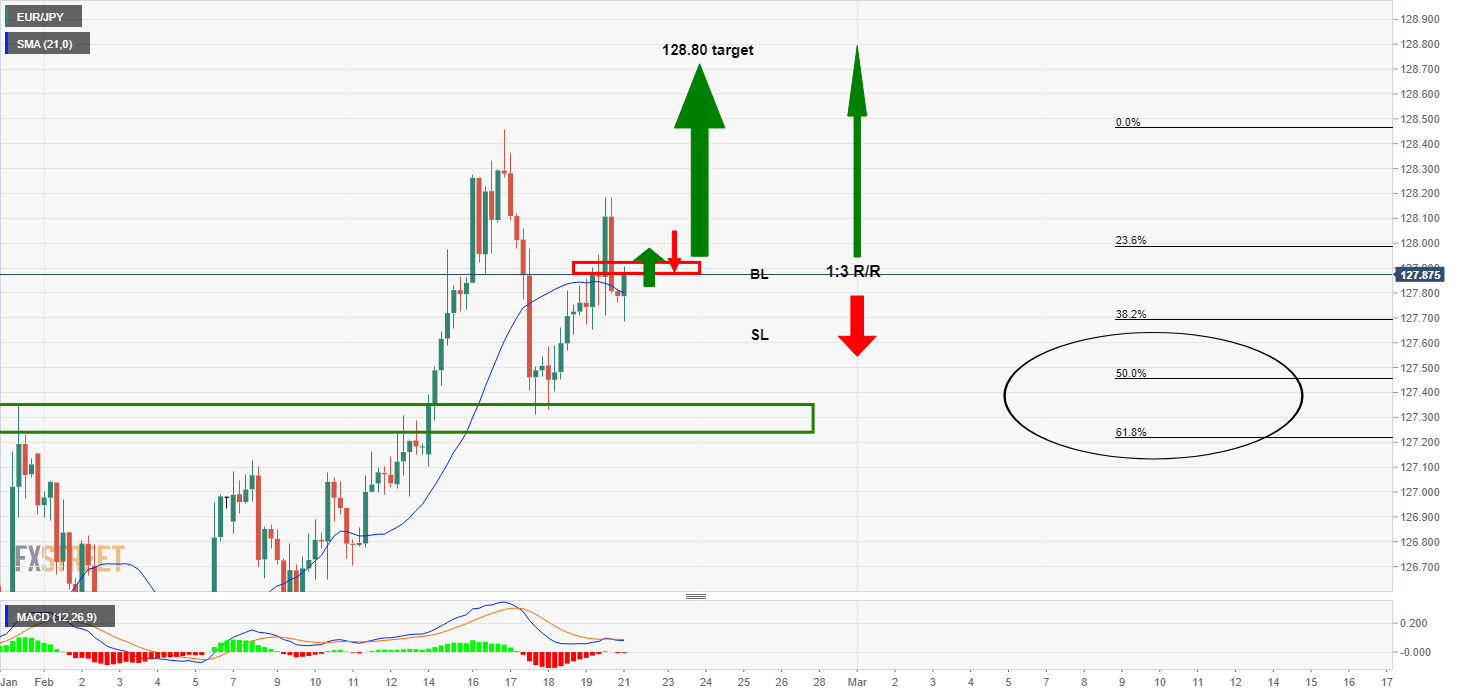

There is a bullish bias on the daily chart and the 4-hour chart is ripening for a buy limit entry.

The cross needs to break the immediate resistance and subsequently retest the structure as support from where bulls can long the pair for a 1:3 risk to reward set up with a stop below structure targeting the 128.80s.

Live market, 4-hour chart

The above chart illustrates attempt 1 (1R loss) and attempts 2, which has now moved above the prior closing highs for a breakeven worst-case scenario by moving the stop loss to the entry point.

At this juncture, the upside is limited to the target and the downside is limited to 1R loss on a compounded position.

One would caution about moving the stop loss any higher considering that the W-formation is a bearish chart pattern and a correction to at least the neckline to test old resistance would now be expected.