- EUR/JPY manages to reverse the initial drop to sub-129.00 levels.

- Further recovery is seen retargeting the YTD highs near 130.70.

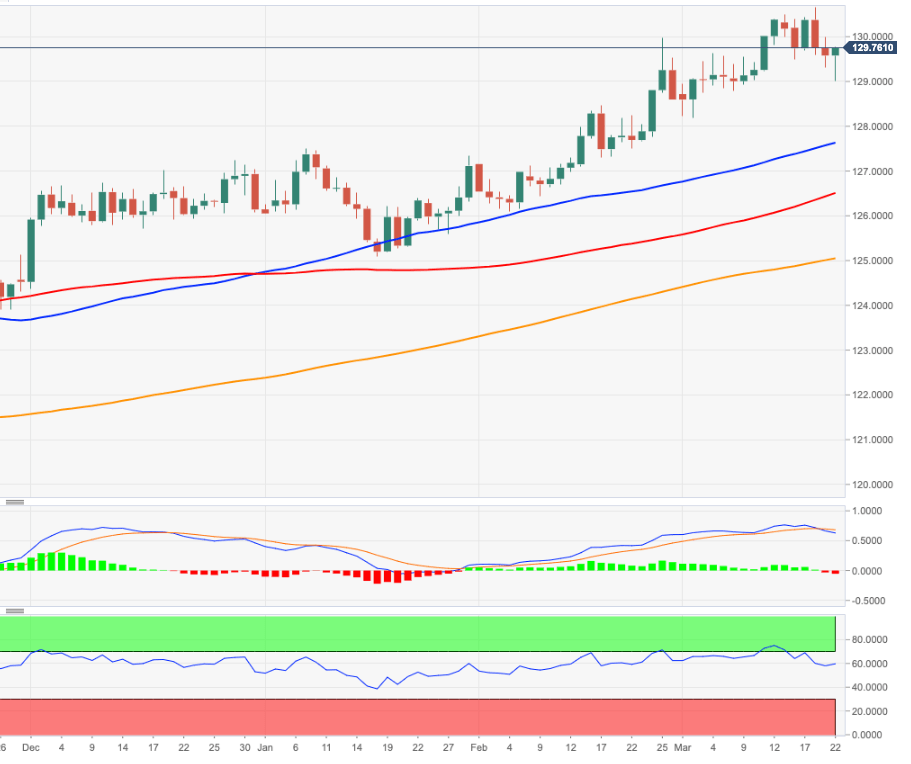

EUR/JPY’s corrective downside appears to have met decent contention in the area below 129.00 the figure so far on Monday.

Despite the corrective downside, the positive bias in the cross remains well and sound for the time being. Against that, further upside still remains on the cards and the surpass of YTD highs near 130.70 should allow for extra gains with immediate target at the 131.00 hurdle followed by the summer 2018 high at 131.98 (July 17).

Reinforcing the current positive stance, EUR/JPY keeps trading above the immediate support line (off November 19 2020 low) in the 127.70 area, also coincident with the 50-day SMA. A breach of this zone is expected to mitigate the upside pressure.

In the meantime, while above the 200-day SMA at 124.97 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart