- EUR/JPY quickly reversed an early uptick to the very important 100-DMA.

- The technical set-up gradually seems to shift in favour of bearish traders.

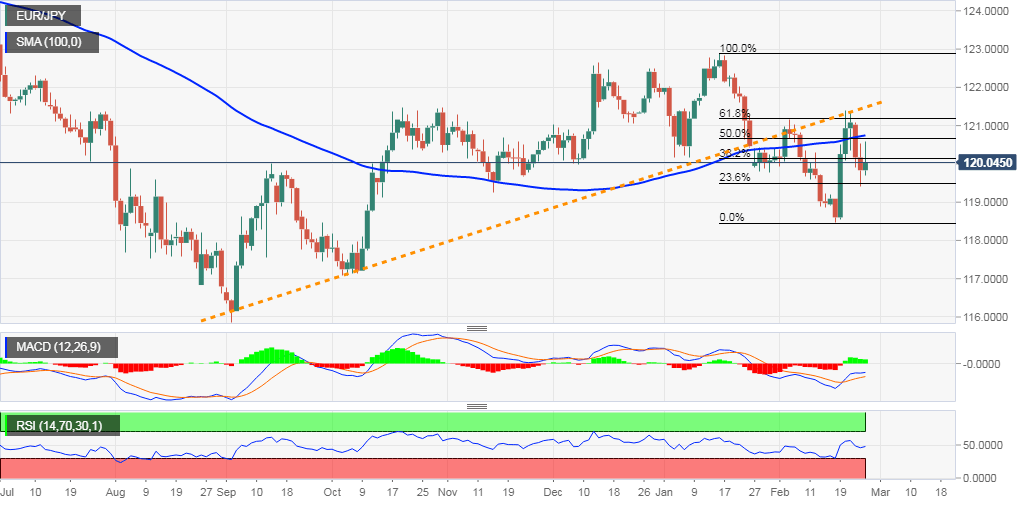

The EUR/JPY cross faded a bullish spike to the 120.60 region and quickly retreated around 50-60 pips from the very important 100-day SMA. The mentioned hurdle coincides with 50% Fibonacci level of the 122.88-118.46 down led and should now act as a key pivotal point for short-term traders.

Given the recent break below a five-month-old ascending trend-line support, the pair’s inability to build on the attempted recovery move, rather failure to find acceptance above a technically significant moving average now seems to suggest the emergence of some fresh selling pressure.

Some follow-through selling below the overnight swing low, around the 119.40 region, also marking 23.6% Fibo. level, will reinforce the bearish outlook. The cross then might accelerate the slide further towards the 119.00 round-figure mark en-route YTD lows, around mid-118.00s.

Meanwhile, a sustained move beyond the 120.60 confluence hurdle might negate the negative outlook and prompt some short-covering move back towards the 121.00 mark. The momentum could further get extended towards the 121.35-40 supply zone, test last week.