- EUR/JPY adds to Monday’s losses below the 127.00 level.

- The YTD peaks near 127.50 emerge as the next hurdle.

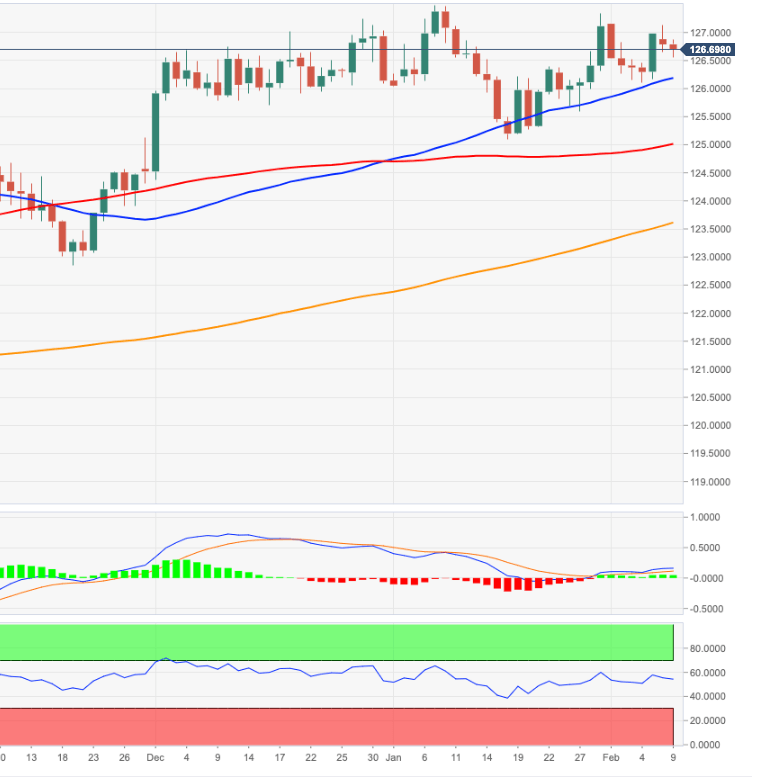

Monday’s test of levels beyond 127.00 the figure seems to have motivated sellers to return to the market, triggering the ongoing correction in EUR/JPY.

In the meantime, price action around EUR/JPY could remain side-lined in the very bear-term, with the upper end at this week’s tops above 127.00 and decent contention in the 126.00 neighbourhood. The 55-day SMA at 126.06 also reinforces the latter.

If EUR/JPY regains the area past 127.00 it should open the door to a potential re-visit of the so far 2021 tops around 127.50 (January 7). Further north comes in the 129.30 zone (November 29/December 13 2018 highs) ahead of the monthly peaks at 130.14 (November 7 2018).

Looking at the broader picture, while above the 200-day SMA at 123.47 the outlook for the cross should remain constructive.

EUR/JPY daily chart