- EUR/JPY sellers attack intraday low, teases confirmation of bearish chart pattern.

- Downbeat MACD, failures to cross immediate resistance line favor bears.

- 200-HMA lures bears, wedge’s upper line adds to the north-side hurdle.

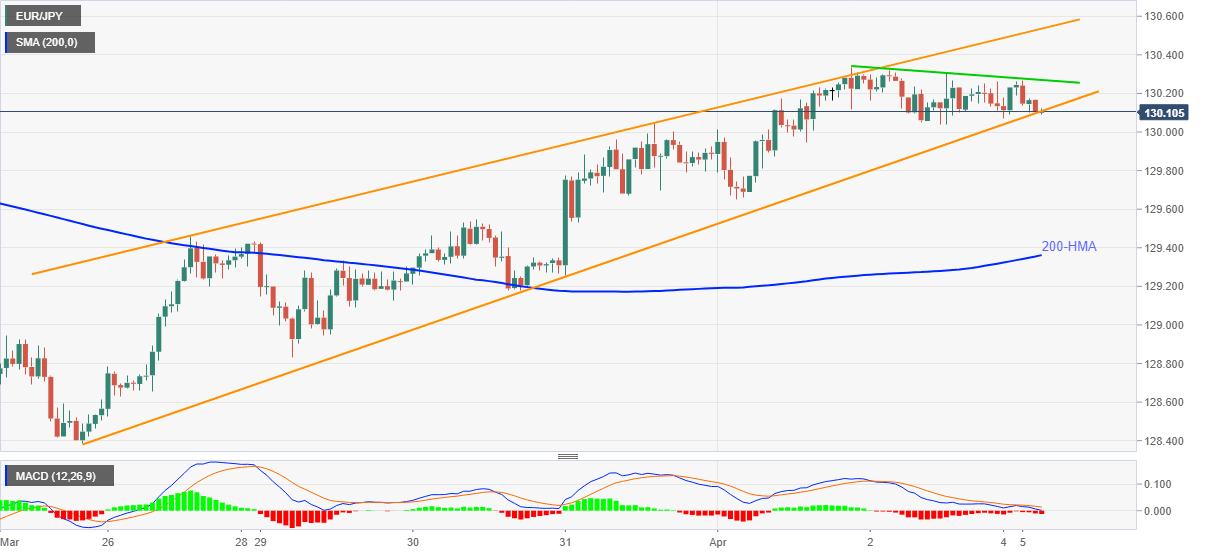

EUR/JPY stays depressed around 130.10 during early Monday. In doing so, the cross-currency pair battles the support line of a one-week-old bearish chart pattern, rising wedge, on the hourly play.

Given the bearish MACD and the pair’s repeated pullbacks from the two-day-long falling trend line, EUR/JPY sellers seem to roll up sleeves to retest the 200-HMA level of 129.36.

However, Thursday’s low around 129.65 and the theoretical target of the bearish pattern confirmation, near the previous month’s bottom of 128.18, will act as extra filters to the south.

On the flip side, EUR/JPY run-up beyond the immediate resistance line, close to 130.30 will need validation from the last week’s peak close to 130.35 before attacking the wedge’s upper line around 130.55.

Also likely to challenge the bulls is the March top surrounding 130.65-70 and late August 2018 high near 130.85.

Overall, EUR/JPY bulls seem tired but the sellers are waiting for confirmation.

EUR/JPY hourly chart

Trend: Further weakness expected