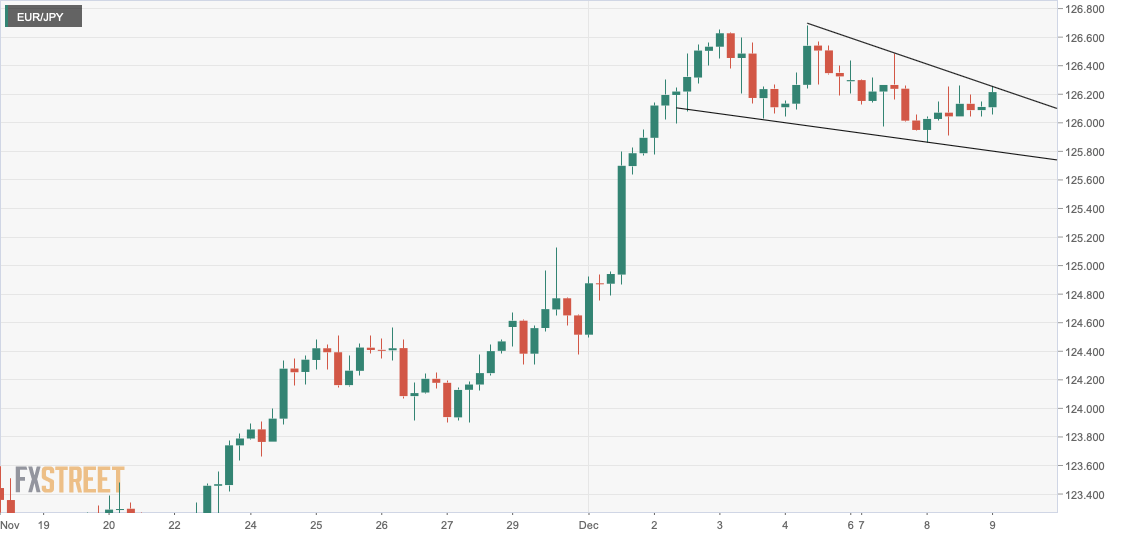

- EUR/JPY trades near the upper end of a 4-hour chart falling chanel hurdle.

- A breakout would signal a continuation of the rally fron late November lows.

EUR/JPY is trading near 126.24, representing a 0.14% gain on the day, having printed a session low of 126.04 early today.

The 4-hour chart shows the currency pair is probing the upper end or resistance of the falling wedge represented by trendlines connecting Dec. 4 and Dec. 7 highs and Dec. 2 and Dec. 7 lows.

A falling wedge comprises trendlines connecting lower highs and lower lows and indicates. These trendlines are converging in nature, as is the case here, and represent seller exhaustion. Hence, a breakout is considered a bullish sign.

A 4-hour close above the falling wedge hurdle at 126.24 would confirm the breakout. That would imply an end of the pullback from the recent high of 126.68 and resumption of the rally from lows near 123.90 observed at the end of November.

4-hour chart

Trend: Bullish

Technical levels