- EUR/JPY stays depressed as sellers extend pullback from 124.56.

- Sustained break of the key HMA, bearish MACD favor bears.

- 200-HMA in the spotlight during further downside.

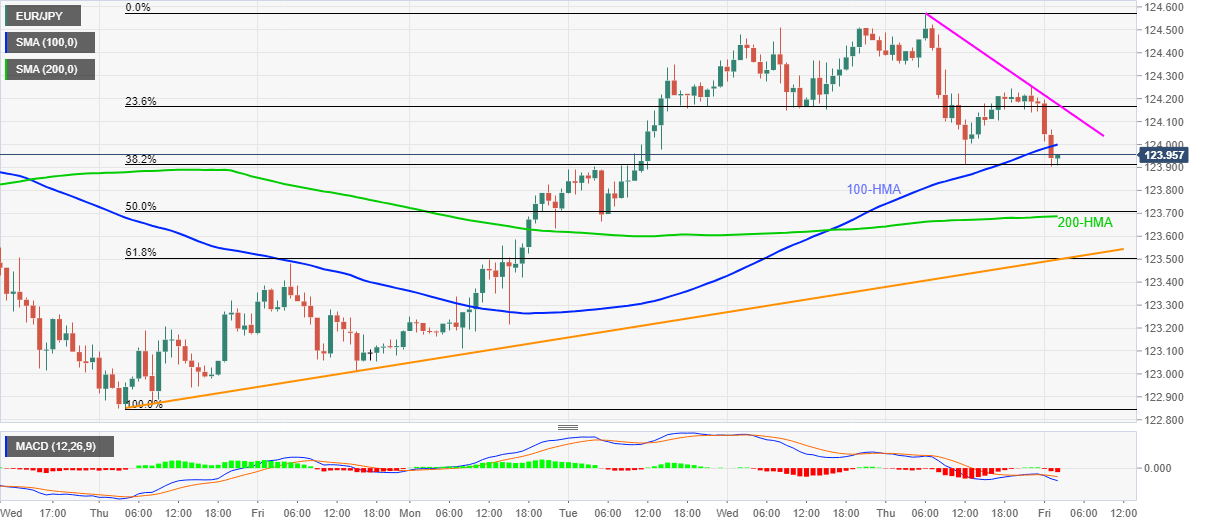

EUR/JPY drops to 123.93, down 0.20% intraday, during early Friday. In doing so, the pair extends the previous day’s pullback after declining below 100-HMA.

Not only the sustained downside past-the key HMA but bearish MACD signals also direct EUR/JPY bears towards 200-HMA re-test, currently around 123.68.

However, a confluence of a one-week-old rising trend line and 61.8% Fibonacci retracement of November 19-26 upside, around 123.50, will restrict the quote’s further weakness.

On the contrary, a two-day-old resistance line, at 124.17, can restrict the EUR/JPY recovery moves beyond the 100-HMA level of 124.00.

Though, bulls are less likely to retake controls unless witnessing the fresh high of the month above 125.15.

EUR/JPY hourly chart

Trend: further weakness expected