- EUR/JPY struggles to rise past monthly tops despite bullish MACD.

- 50-day EMA, 23.6% Fibonacci retracement acts as nearby key support.

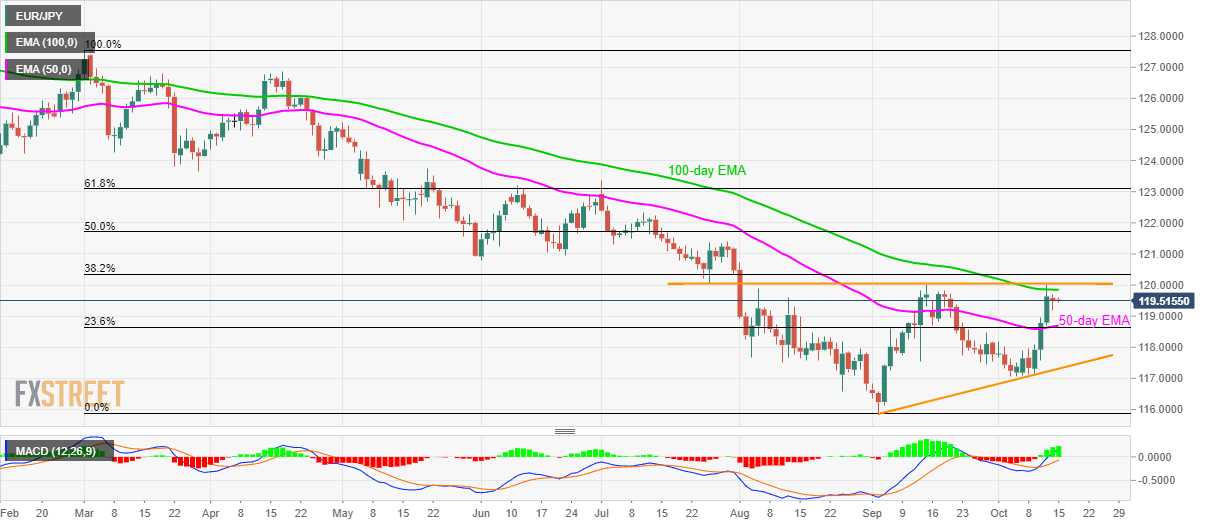

EUR/JPY stays below 100-day EMA and key horizontal resistance while taking rounds to 119.52 during the early Asian session on Tuesday.

The pair fails to justify the bullish signal by the 12-bar Moving Average Convergence and Divergence (MACD) indicator, which in turn increases the odds of a pullback to 118.70/65 support-zone including 50-day Exponential Moving Average (EMA) and 23.6% Fibonacci Retracement of March-September declines.

In a case prices keep sliding past-118.65, a six-week-old rising trend line at 117.30 seems crucial for sellers to watch.

On the upside, a 100-day EMA level of 119.85 acts as immediate resistance for the pair ahead of highlighting 120.00/05 horizontal barrier including September month top and late-July low.

Should there be increased rise beyond 120.05, 121.00 will flash on the bulls’ radar to target.

EUR/JPY daily chart

Trend: pullback expected