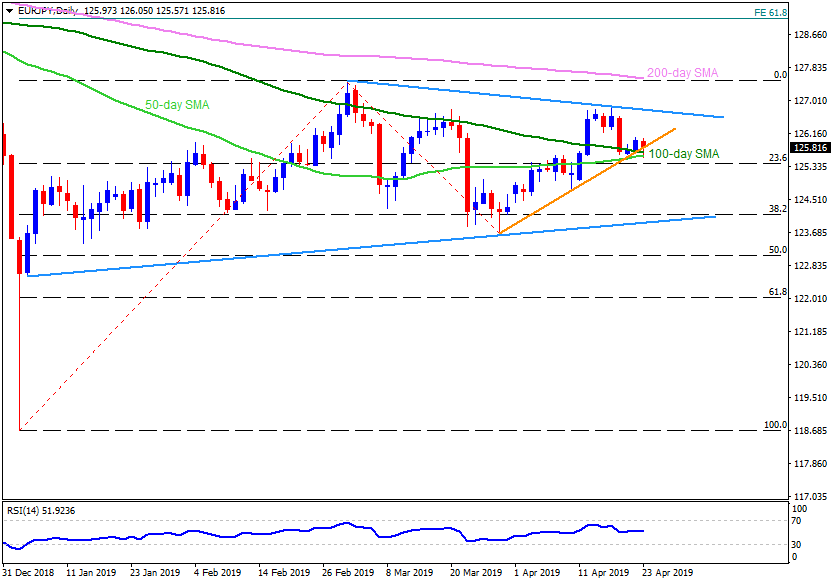

Failures to extend Monday’s recovery beyond 126.10 isn’t speaking loud of the EUR/JPY pair’s weakness as not only 50-day and 100-day simple moving averages (SMA) but a four-week-old ascending trend-line also restricts the quote’s downside around 125.70/60 during early Tuesday.

As a result, chances of witnessing another uptick of 126.10 can’t be denied, a break of which may escalate the pair towards a descending trend-line stretched since March-start, at 126.75.

In a case buyers manage to overcome 126.75 on a daily closing basis, the 127.50/55 area including 200-day SMA and recent high gains market attention as it holds the door for the pair’s rally to 61.8% Fibonacci expansion of January to April moves, near 129.10.

Meanwhile, a downside break of 125.60 can recall 124.70 whereas an upward sloping trend-line since January 04 can question the bears’ strength around 124.00 – 123.90.

If at all prices slip beneath 123.90, 125.60 and 122.50 could become sellers’ favorites.

EUR/JPY daily chart

Trend: Positive