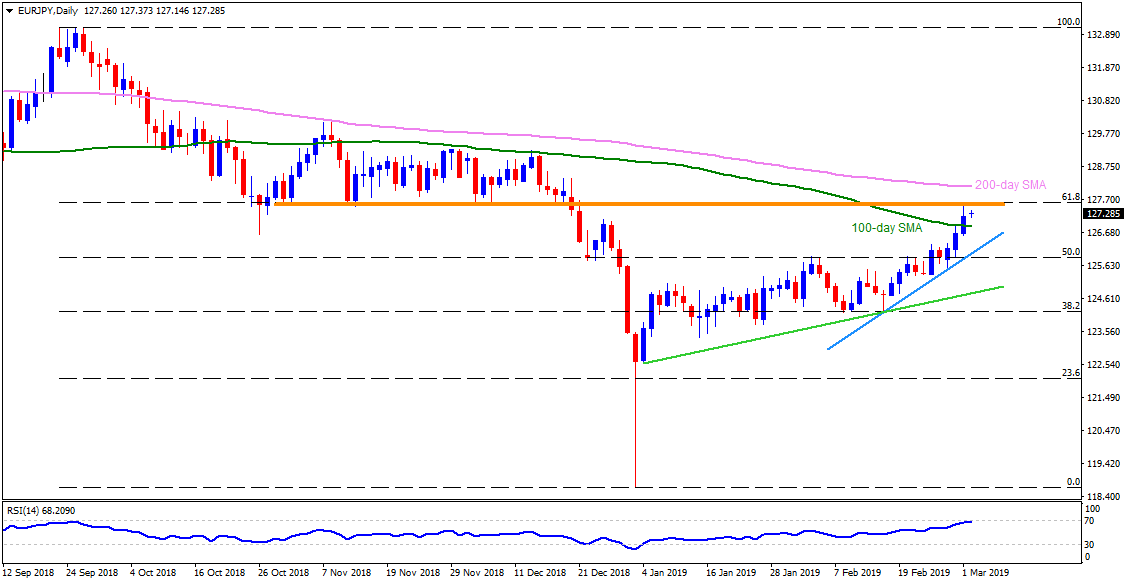

- The EUR/JPY pair trades near 127.30 during early Monday.

- The pair successfully trades beyond 100-day simple moving average (SMA) for the first time in a year but is yet to clear the 127.50-60 resistance-region, including 61.8% Fibonacci retracement of its September – January south-run.

- Should prices manage to conquer 127.60 upside barrier, 200-day SMA level of 128.15 is likely another stop that can challenge buyers.

- During the pair’s rise after 128.15, 129.30 and 130.00 might become bulls’ favorites.

- Meanwhile, 100-day SMA level of 126.85 can act as immediate support for the pair, a break of which can print 126.40 on the chart.

- However, 50% Fibonacci and an upward sloping support-line joining the lows of February 15 and 27 could limit the quote’s downside at 125.85.

- It should also be noted that bears’ dominance past-125.85 might not hesitate to flash 125.00 as a quote.

EUR/JPY daily chart

Additional important levels:

Overview:

Today Last Price: 127.26

Today Daily change: 1 pips

Today Daily change %: 0.01%

Today Daily Open: 127.25

Trends:

Daily SMA20: 125.45

Daily SMA50: 125.08

Daily SMA100: 126.83

Daily SMA200: 128.12

Levels:

Previous Daily High: 127.52

Previous Daily Low: 126.6

Previous Weekly High: 127.52

Previous Weekly Low: 125.38

Previous Monthly High: 126.92

Previous Monthly Low: 124.16

Daily Fibonacci 38.2%: 127.17

Daily Fibonacci 61.8%: 126.96

Daily Pivot Point S1: 126.73

Daily Pivot Point S2: 126.21

Daily Pivot Point S3: 125.81

Daily Pivot Point R1: 127.65

Daily Pivot Point R2: 128.04

Daily Pivot Point R3: 128.56