- Bears in control of EUR/JPY, with resistance a tough-nut to crack.

- Dips lower to find support at the 55-day ma at 118.84/44.

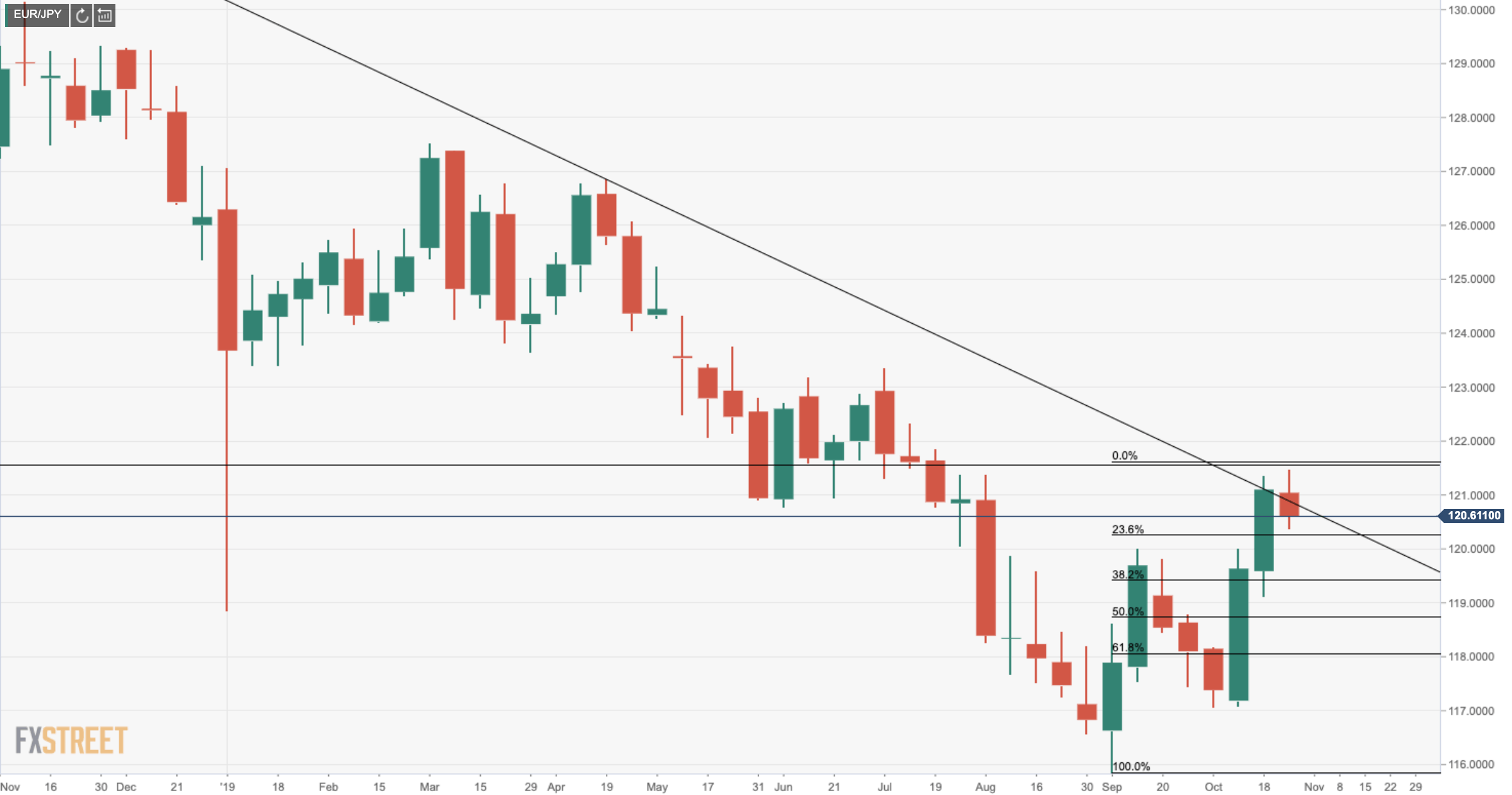

EUR/JPY has been under pressure again with the 23rd Oct upside correction stalling below the previous swing highs around 121.50, with the downside bias supported by the 4-hour bearish pin-bar posted earlier on in the week – Indeed, this is a 50% Fibonacci level which is proving to be a tough nut to crack on the upside, a resistance area that is hardened with confluence of the 2018-2019 downtrend.

“The break has been minor and we look for it to continue to hold the topside,” analysts at Commerzbank argued, adding that “dips lower will find support at the 55-day ma at 118.84/44, ahead of the 117.65 uptrends. Above here lies the 200-day ma at 122.27 and the 123.34 July high.”

Also worth noting are the Fibonacci levels of between the early Sep’ lows to recent swing highs of Oct’ which can be located at 120.15, as the 23.6% retracement (meeting 12th Sep resistance), 119.33 as the 38.2% and 118.66 as a 50% mean reversion target.

Weekly chart