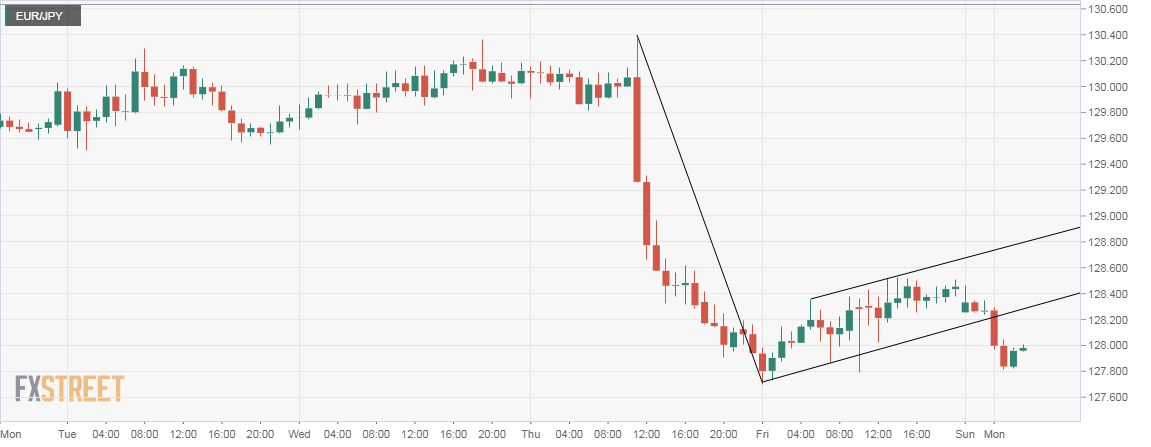

- The EUR/JPY hourly chart shows a bear flag breakdown – a bearish continuation pattern, which indicates the sell-off from the high of 130.36 has resumed.

- The JPY is solidly bid in Asia on escalating US-China trade tensions and could extend gains further on escalating US-China trade tensions.

Hourly chart

Spot Rate: 127.95

Daily High: 128.42

Daily Low: 127.82

Trend: Bearish

R1: 128.42 (daily high)

R2: 128.82 (5-day moving average)

R3: 129.04 (10-day moving average)

Support

S1: 127.70 (previous day’s low)

S2: 127.49 (50% Fib R of May 29 low – June 14 high)

S3: 126.81 (61.8% Fib R of May 29 low – June 14 high)